Ichimoku Analysis (1-Hour Chart)

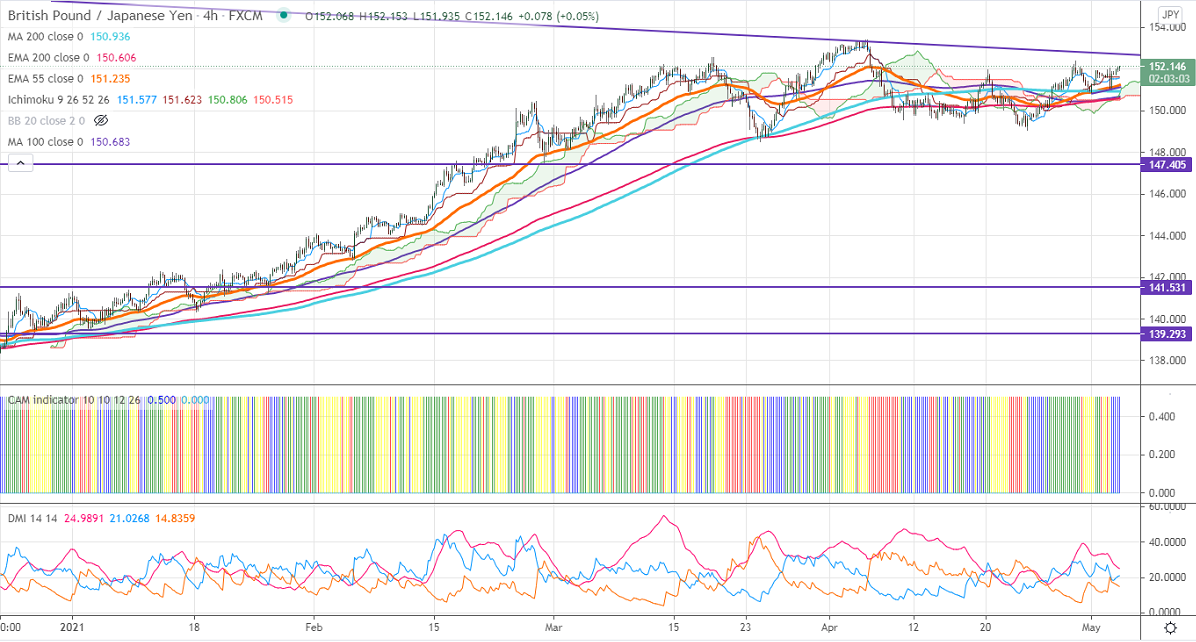

Tenken-Sen- 152.02

Kijun-Sen- 151.62

GBPJPY has once again surged after hitting a low of 151. The pair hits a low of 150.87 on May 2nd and recovered to 152.05. The intraday trend of the pair is bullish as long as support 150.80 holds. The pound sterling is trading below 1.3900 on broad-based US dollar buying. The comments from US Treasury Janet Yellen that rates need to rise as the economy improves. USDJPY is holding above 200-W MA and a break above 110 confirms a bullish continuation. The risk aversion by investors due to the spread of coronavirus is helping the Japanese yen.

Technical:

The pair's near-term resistance around 152.40, any break above will take the pair to next level till 152.81 (trend line resistance) /153.40. On the lower side, near-term support is around 151.50. Any indicative violation below that level will drag the pair down to 151.10/150.80/150.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well above 4-hour Kijun-Sen and below Tenken-Sen, cloud.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to buy on dips around 151.50 with SL around 151 for a TP of 153/153.40.