The British economy advanced 0.5 pct on quarter in the three months to September of 2016, slowing from a 0.7 pct expansion in the previous period and in line with the preliminary estimate. Net external demand was the main driver of growth, while household expenditure and fixed investment rose at a slower pace.

But GDP forecast for 2017 has been revised up to 1.0% and remove our call of a rate cut early next year. Rather, we expect the BoE to remain on hold over the forecast horizon.

We also highlight that trend growth has decreased in recent years to about 1.5% today. Brexit, if anything, poses downside risks to this estimate.

Inflation and retail sales data released this week came in on the strong side, while the labor market report showed that employment fell and claimants increased.

The discounted gloomy UK outlook both prevents a new bold depreciation and a much stronger currency. The technical picture suggests a new turbulence and bearish pressures.

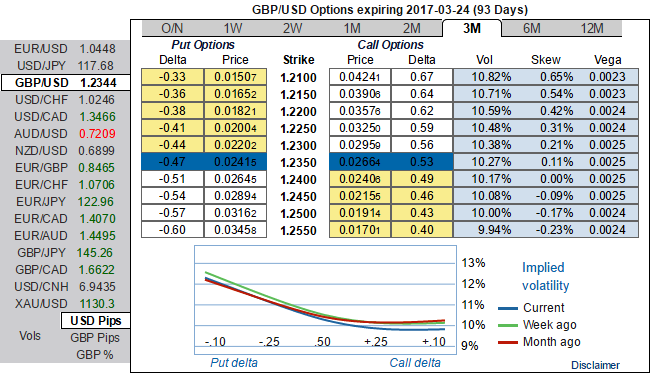

Owing to the above fundamental factors, GBP vols and risk reversals have been unchanged but to remain negative flashes to mitigate bearish risks in long run, while IV skews are also bidding OTM put strike which is line with the risk reversal indications.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close