• GBP/USD edged lower on Monday as the greenback firmed ahead of the release of the minutes from the Federal Reserve's December meeting.

• The Federal Reserve will release minutes from its December meeting later on Tuesday, with markets pricing in two rate cuts next year.

• The minutes are expected to highlight policy disagreements over a third straight rate cut and signal a near-term pause in 2026.

• Trading volumes are expected to remain light in the holiday-shortened week, with U.S. markets closed on Thursday for New Year’s Day.

• On the geopolitical front, Russia accused Ukraine of attempting to attack President Putin’s residence and vowed retaliation, dimming hopes for a peace deal.

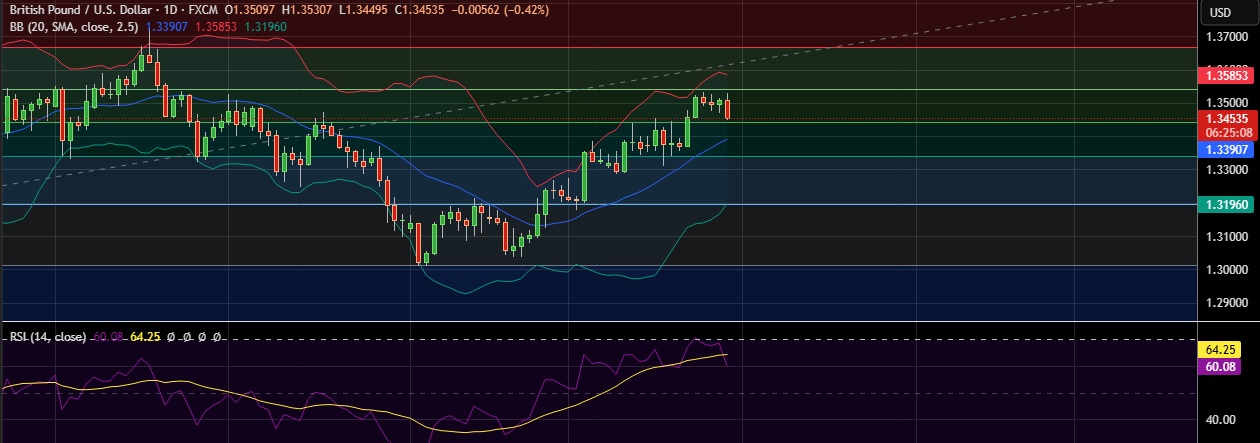

• Immediate resistance is located at 1.3541(38.2%fib), any close above will push the pair towards 1.3586(Higher BB)

• Strong support is seen at 1.3445(50%fib) and break below could take the pair towards 1.3391(SMA 20).

Recommendation: Good to buy around 1.3450, with stop loss of 1.3370 and target price of 1.3550