The government has published its bill to trigger article 50, prompting Labour to table a series of proposed amendments, including one seeking to guarantee that parliament gets a final say on any final deal for Brexit.

The bill, containing just two clauses and only 137 words long, will be granted five days of time in the Commons, the government announced, prompting concern from some Labour MPs that it could not receive proper scrutiny in such a period.

Devised after the government this week lost its supreme court case on whether it could trigger article 50 without the approval of parliament, the EU (notification of withdrawal) bill states as its aim to “confer power on the prime minister to notify, under article 50(2) of the treaty on European Union, the United Kingdom’s intention to withdraw from the EU”.

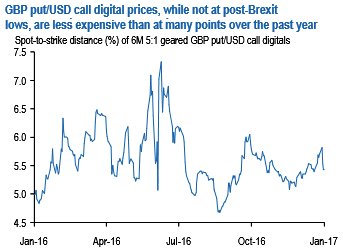

GBP put/USD call digitals: GBP put/USD call digital prices, while not at absolute post-Brexit lows, are less expensive than at many points over the past year (refer above chart).

For instance, 5% OTMS cable put digitals offer maximum gearing of nearly 5 times, in the upper-end of the historical range of the past year since the Brexit referendum entered the market's consciousness as a risk event to reckon with.

9M -1Y 1.15 strike GBP put / USD call at-expiry digitals for instance cost in the vicinity of 16%-17% (mid, spot ref. 1.2563), which is a shade below the realized frequency of annual 5% -10% GBP spot declines over the past 20-years.

The inference is that there is little risk premium in option prices for the possibility of a material drop in sterling that could materialize in the event of a disorderly Brexit; at the very least, anxiety about such an eventuality is nowhere near post-referendum highs and not particularly elevated relative to historical spot outcomes.

Digital options also offer a friendly decay profile and are suitable to hold through a long drawn Article 50 process that will play out over a period of months.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed