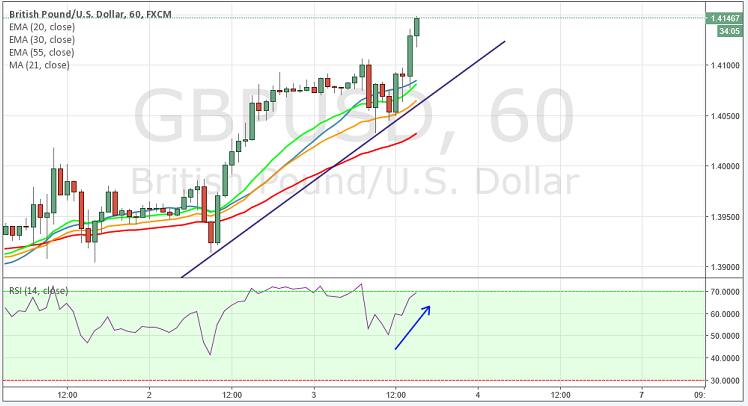

GBP/USD inched higher against US dollar by hitting daily highs at 1.4148 during early American hours, before making a short dip after the release of positive ISM non-manufacturing PMI.

- The pair has held above 1.4100 levels indicating short term buying interest across the board. Currently the pair is trading around 1.4139 above daily pivot point located at 1.4114 and is supported by a raising trend line.

- Technically in the 4 hour chart the 55, 30 and 20 MA is turning upwards from the current price action, the RSI is indicating towards upside at 63.

- To the upside, the strong resistance can be seen 1.4200; a break above this level would expose the cable to next resistance level at 1.4245.

- To the downside immediate support can be seen at 1.4021, a break below at this level will open the door towards next level at 1.3912.

Recommendation: Go long around 1.4100, targets around 1.4180/1.4220, SL 1.3950

Support levels: S1-1.4021, S2-1.3912, S3- 1.3824

Resistance levels: R1-1.4144, R2- 1.4200,R3-1.4245