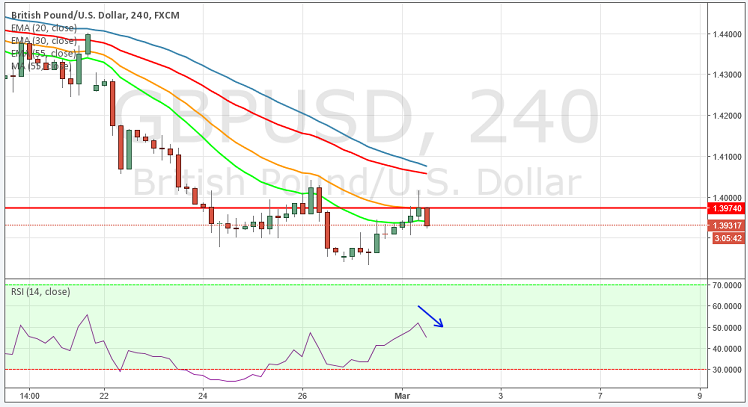

GBP/USD rebounded strongly towards 1.4000 earlier in mid European session. However, the pair turned back after failing to break resistance level 1.4015, as the pound ran out of strength against US dollar.

- The pair has to break resistance level at 1.4045 levels in order find any bullish momentum, unless until trend continues to be strongly bearish for this pair.

- Technically the pair has extended its decline below its 55 DMA, the RSI in the 4 hour chart is indicating downwards at 47, meanwhile the 55, 30 and 20 MA's are pointing strong bearish momentum towards lower side. Overall the technical indicators are depicting further downtrend for this pair.

- To the upside, the strong resistance can be seen at 1.4045, a break above this level would expose the cable to next resistance level at 1.4100.

- To the downside immediate support can be seen at 1.3926, a break below at this level will open the door towards next level at 1.3870.

Recommendation: Go short below 1.3960, targets 1.3880, 1.3840, SL 1.4000

Resistance Levels

R1: 1.3981 (61.8% Retracement level)

R2: 1.4015 (Daily high)

R3: 1.4045 (Feb 26th high)

Support Levels

S1: 1.3926 (50% Retracement level)

S2: 1.3870 (38.2% Retracement level)

S3: 1.3800 (23.6% Retracement level)