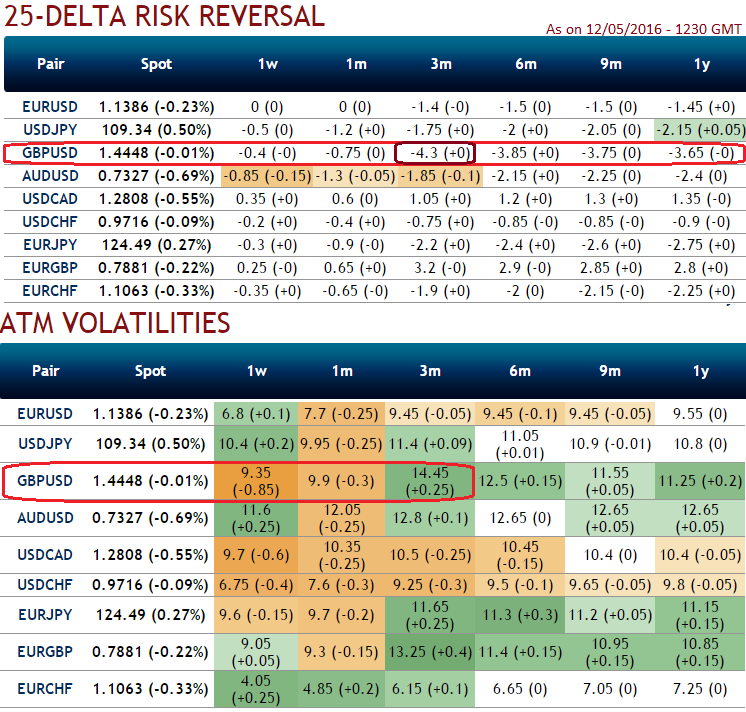

We would still recommend a GBP/USD 3M risk reversal i/o 1Y as a generic hedge for Brexit risk as they flash negative 4.3 which is highest among the G10 currency pairs.

GBP/USD gains major share in OTC markets in next 3 months’ tenors. Hence, the demand for GBP puts/USD calls have spiked on fears of UK exit from the EU.

3M IV is trading at 14.25% which is highest among G10 currency segment, (earlier 15.23%) which is highest level in last 70 months, IV touched 16.9% in May 2010, when Prime Minister Cameron was suffering coalition issues post-election.

These highest negative risk reversals divulge different insights in OTC FX in various circumstances:

If the foreign trader is agreeable to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate.

If he wants to lock in a worse but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer.

If he is unwilling to pay or wants to cut down the premium payment as compared to those payable in case of forex options.

With the adjustment to the IVs, risk reversals and next significant event that can have the major impact on GBPUSD would be UK referendum (that is scheduled on 23rd June, approximately one and half months from now).

Pound just snapped back from critical lows against Dollar so far in last 3 months or so but price actions clearly suggests vulnerabilities still linger. Over the past 2 weeks, Pound has dropped more than 400 pips against Dollar but recovered a bit.

To substantiate, we would foresee GBP on weaker side on BoE's alerts of the economic risks if Britain votes to leave the European Union, saying on Thursday that sterling could tumble harshly and unemployment would probably rise. The central bank sends this caution of this event risk after leaving their bank rates unchanged at 0.50%.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX