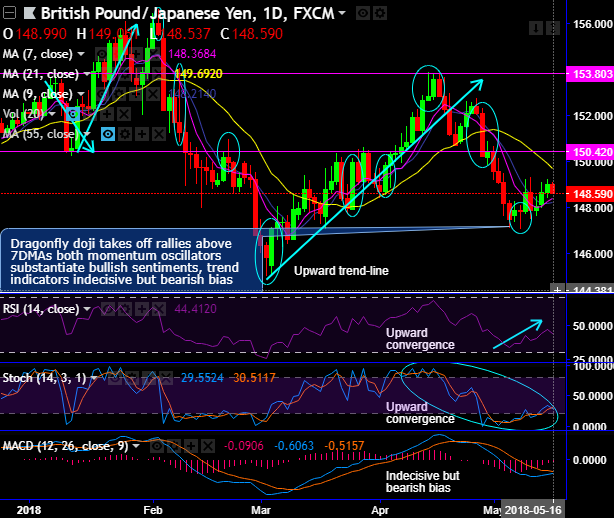

Chart and candlestick patterns occurred: Dragonfly doji has occurred at 147.821 levels to bottom out when price dips were countered by bulls last week.

Ever since the occurrence of this bullish pattern, the rallies take off rallies above 7DMAs both momentum oscillators substantiate bullish sentiments, trend indicators indecisive but bearish bias (refer daily chart).

While the intermediate trend spikes through rising channel (refer weekly chart), where shooting star candle occurs at channel resistance and evidences considerable slumps below DMAs but cushions at channel support.

For now, as the bulls have tested the strong support at channel baseline, consequently, the bulls are likely to extend rallies. But the same is not cushioned by technical indicators.

Both RSI and stochastic oscillator on weekly terms have been converging downwards that indicate strength and momentum in the selling sentiments.

While MACD substantiates bearish interests, signals extension of price slumps.

Trade tips:

On speculative grounds, at spot reference: 148.440 levels, we advocate buying one-touch call options choosing upper strikes at 149 levels.

Alternatively, one can add shorts in futures contracts of mid-month tenors with a view to arresting potential downside risks.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 6 (which is neutral), while hourly JPY spot index was at 11 (neutral), while articulating (at 09:47 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: