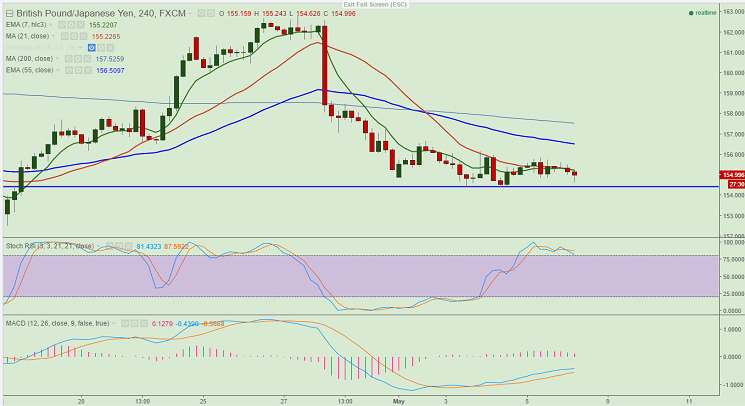

- Major resistance- 156

- Major support – 154.40 (May 4th low)

- The pair has once again recovered after making a low of 154.62 at the time of writing. It is currently trading around 155.10..

- Short term trend is slightly bullish as long as support 154.40 holds.

- Any violation below 154.40 will drag the pair down till 152.50/151.65.

- On the higher side any break above 156 will take the pair till 157.25/157.89 (200 4 HMA).

- The pair should close above 158.50 (4 Hour Kijun-Sen) for further upside till 160/162.50 in short term.

It is good buy at dips around 154.40 with SL around 153.25 for the TP of 157.25/157.89.