GBPJPY has consistently been dipping from the recent peaks of 147.148 levels to the current 142.750 levels while articulating (at 08:18 GMT). We’ve explicitly highlighted further bearish potential of this pair in the days to come in our technical section, please follow below weblink for more reading on the same:

Fundamentally, as we continue to foresee the trade apprehensions ratchet up on brexit pressures, the GBPJPY likely to prolong its bearish streaks amid minor spikes against the Japanese yen in a typical “risk off” move. These bearish sentiments are factored-in OTC markets.

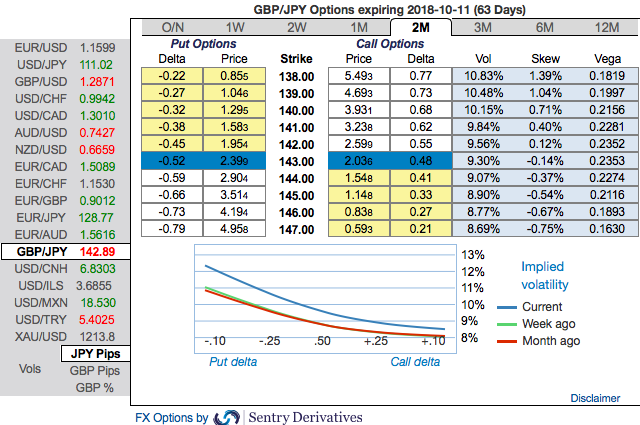

OTC outlook and Hedging Strategy: Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 138 levels (refer above nutshell evidencing IV skews).

Accordingly, put ratio back spreads couple of days ago were advocated, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on any abrupt momentary price rallies and bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize delta longs.

The execution: Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options. A move towards the ITM territory increases the Vega, Gamma and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair.

The fresh delta longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy by reducing the cost of hedging.Thereby, the above positions address both upswings in short run and bearish risks in long run by delta longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -111 levels (which is bearish), while hourly JPY spot index was at 153 (bullish) while articulating (at 08:35 GMT). For more details on the index, please refer below weblink:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed