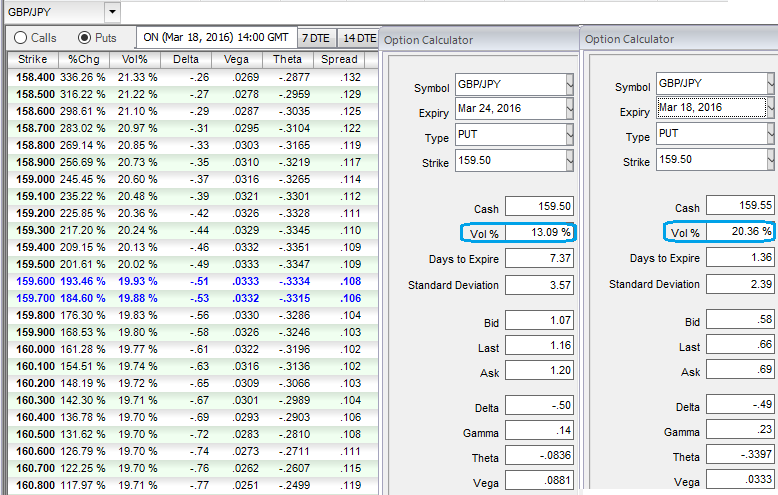

Please have a glance on how implied volatilities of ATM puts of 1D and 1W expiries are acting crazily in OTC markets, 20.36% and 13.09% respectively ahead of Bank of England's monetary policy which is most likely to be unchanged.

In spot FX of GBPJPY, the pair has again drifted below from recent highs of 163.981 to the current 159.663 levels, what is weighing on the pound's slumps is that, the expectations on BoE unlikely changes but the chances for lower interest rates in 2016 has grown up to 23%, an increase from the February survey that had placed the odds at only 10%, above all lingering Brexit probabilities add an extra pressure on sterling's depreciation.

With almost unlikely changes in BoE, FX option markets have been factoring GBP depreciation by 20% is divulging the weakness in this pair and it means the market thinks the price has potential for large movement in downward direction.

We advocate the suitable strategy to hedge these downside risks by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

Hereafter, you can have a view on daily charts (the bearish signal spotted as you can see that from circled area, long put instruments to generate positive cash flows here onwards).

With the below technical reasoning, we think arresting potential downside risks of this pair by hedging through Put Ratio back Spread and accordingly, hedging framework was also suggested earlier, for now it is reckoned that the underlying currency GBPJPY to make a large move on the downside.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times.

By now shorts side of 1 lot of 1W (1%) ITM put option would generate assured returns on any abrupt rallies.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM

Or on the likelihood of an option far into-the-money not expiring ITM.

ATM options are far more sensitive since higher IV greatly increases their chances of expiring ITM which is why we prefer ATM strikes to adding more weights in longs of this strategy.