The yen is pressurized against the US dollar, the pair spiked to the highs of 102.784, settled to trade at 102.040 levels currently, trimming its advance this year to about 17 percent. While GBPJPY is no exception, has spiked 133.261 levels.

The BOJ faced a backlash after first deploying negative rates in January. Kuroda recently acknowledged that negative rates had cut into financial institutions’ profits by driving long-term yields lower while pointing out borrowing costs for businesses and consumers had also fallen.

BOJ policy outlook in a nutshell:

Policy rate: -0.1%

JGB purchase: 80 trillion yen

ETF purchase: 6 trillion yen

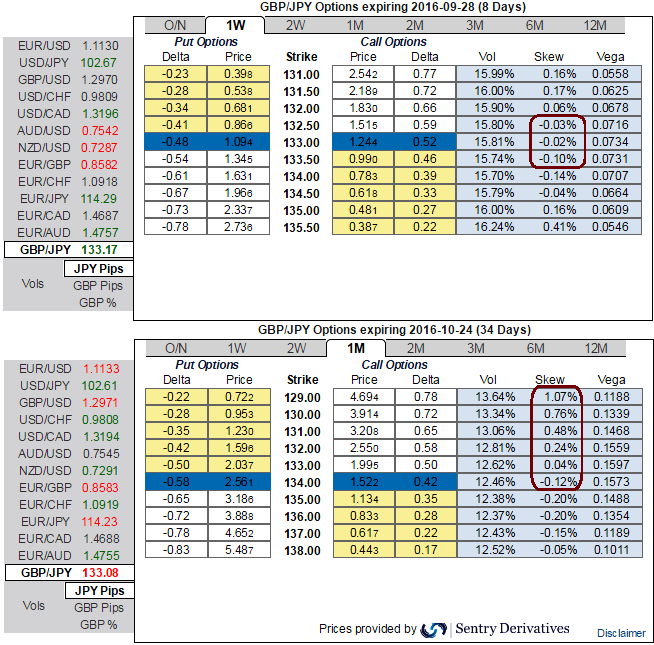

GBPJPY OTC Outlook:

1w IV skews are equally interested in both OTM calls and OTM puts, while 1m skews signify the hedging interests in OTM put strikes.

Usually, pondering over the option sensitivity tool, IVs indications are puzzling in 1w tenors but short upside sentiments could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

The long term bears of this pair can load up shorts in underlying pair with longer tenors to arrest major downtrend as the selling momentum is intensified by leading oscillators with mammoth volumes.

So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend.

For the ease of understanding, we’ve just considered this option strategy with shorts in 1W (1%) ITM put with positive theta or closer to zero while buying 1M (0.5%) OTM put option; the strategy could be executed at net credit.

Theta on short side measures time decay in your options premium value per day which means the premiums on short leg today is worth more than over every time break even if the underlying spot doesn’t move anywhere, all else been equal, the option premium should be waning out. This would be the case even when underlying spot never goes up but remains in sideways.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data