UK data radar:

Net lending to individuals (BoE release) on Tuesday.

GFK consumer confidence on Wednesday.

PMI survey, manufacturing on Thursday.

PMI survey, construction on Friday.

OTC updates:

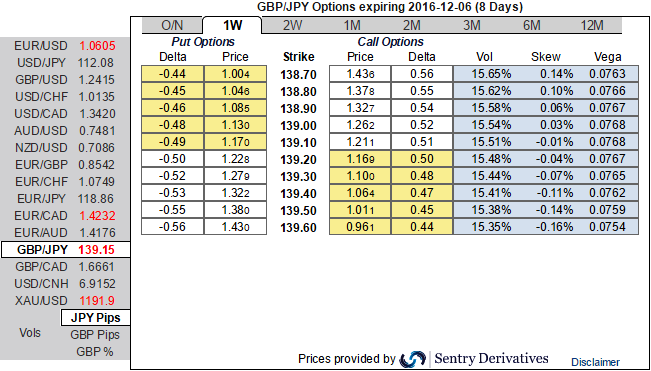

Let’s glance through that the IV skews of both 1w and 2w tenors that are more biased towards OTM put strikes, but the less significant changes in prevailing rates of GBPJPY spot (spot ref: 139.10) can indicate a slight change in market expectations for the upward direction in the underlying forex spot rate but the bearish interests in long run remain intact and therefore the price of ATM puts are more sensitive as the OTM put strikes have HY vols.

Why would there be a difference in the implied volatility levels of at-the-money options and put options with strikes below the current spot price?

Because these implied volatilities level associated with an option does not only reflect the expected level of actual volatility in the underlying spot FX (or else it would indeed by the same for all options on the same underlying expiring on the same day).

Rather, the implied volatility level also reflects the supply and demand for options who only vary in terms of their strike.

Here, in this case, the positively put skews and puts are trading at 30% implied volatility levels compared to at-the-money options which are trading at say 20%, then this is because the demand for these puts is higher.

Why might the demand be higher? Well, in the case of put options on say underlying spot FX, a positive put skew might reflect demand from investors looking to hedge their downside risk. There can be a natural bias in the market to prefer downside protection to upside protection (because investors tend to be naturally long the underlying market).

So an ‘options put skew’ refers to the level of implied volatility for options whose strike is below the at-the-money price relative to the implied volatility of at-the-money options.

Use upswings to deploy “credit put spreads”

Well, any abrupt upswings should not be panicky, instead deploy them in the below option strategy.

Using these deceptive rallies, you decide to initiate a bull put spread at net credits that is likely to fetch certain yields, short 1W (-1.5%) in the money put with positive theta if you expect that GBPJPY will spike up moderately over the next near future but certainly not beyond your imagination, simultaneously, buy next month at the money -0.49 delta put option.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data