Hedging GBPJPY further downside risks with Put Ratio Back Spreads (PRBS):

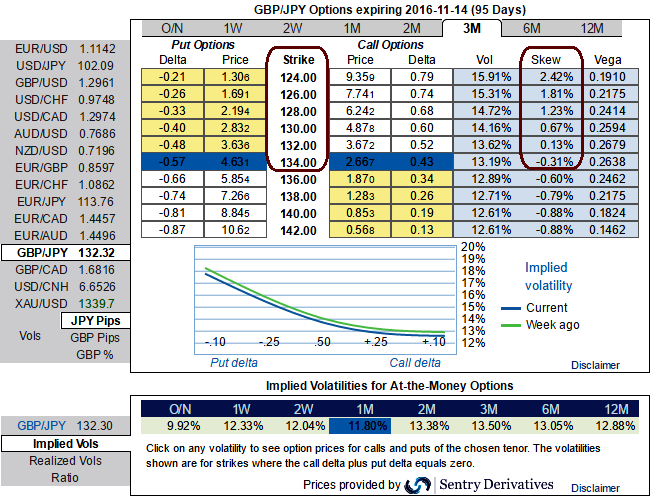

The ATM IVs of GBPJPY of 2W expiries are at just tad above 12%, and 13.50% for 3M tenor.

Although the momentum in short term bear trend is reduced, but from last couple of weeks regained the strength, Yen against sterling has again been gaining considerably (about 7.13% while articulating) as both all technical indicators are still signalling selling sentiments.

But if you have to evaluate the ATM IVs with the monthly technical chart, the prevailing bearish swings are moving in sync with the same momentum in rallies as we are seeing it right now.

Technically, although there are attempts of upswings we see a stiff resistance at 133.058 levels with leading indicators showing intensified selling momentum.

So, comparatively lower IV (2w tenors) implies the market thinks the price will not move much and so that it is beneficial for option writers.

Whereas, higher IVs (3m) with positive skews towards OTM put strikes would mean the market thinks the price has a potential for large movement in the southward direction, thereby put holders in this span would be in competitive advantage.

Since more downside risks are still on the cards in long run, as result of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in abrupt upswings in short terms is not possible as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively.

So, the strategy goes this way, short 1W (1%) ITM put option, go long in 2 lots of 1M ATM +0.49 delta put options.

With set these narrow strike differences, because the profit potential is greater so that the ratio needed is also lower to profit on underlying movement. You want to take this trade if you think this pair can go lower, but not crash below 1% strikes (the OTM shorts).

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?