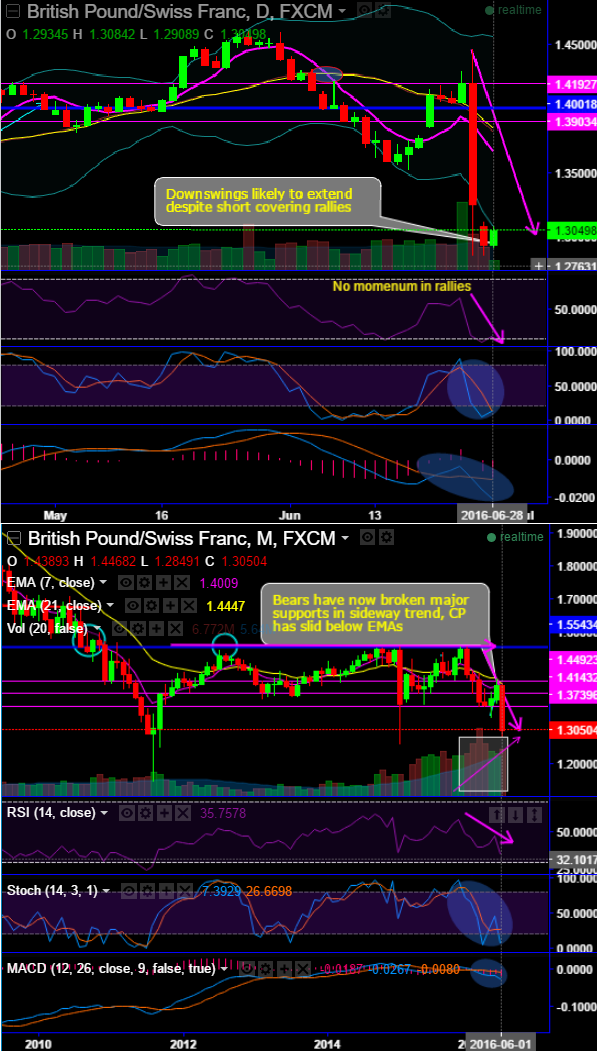

The pair is trading at around 4 and half years lows after Brexit shock.

Bulls seem to be completely edgy as bears momentum is intensified, especially after clearing major supports at 1.4143 and 1.3739 levels.

Current prices have slid well below EMA curves on monthly charts, and for now heading to hit a fresh 5 year lows.

For now, any price jumps are viewed as a better shorting opportunity rather than fresh long build ups

Strong sell signal is generated by lagging indicators as 7DMA crosses below 21DMA, same is the case on monthly patterns, 7EMA crosses below 21EMA.

RSI converges to the tumbling prices both on daily and monthly graphs.

While, stochastic oscillator approaches bearish territory but sign of %K crossover that signifies the bullish momentum.

Most importantly, please be noted that the huge volume build-up on recent bearish trend that can be viewed as healthy confirmation in prevailing downtrend.

GBPCHF should be bearish going forward to break below choppy range but certainly not a long opportunity for now.

Option-trade set up: On medium term hedging perspective, debit put spreads are advocated as the selling indications are piling up on technical graphs of all time frames.

So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

So, go long in 1M (1%) In-The-Money -0.62 delta put and simultaneously writing 1W (1%) Out-Of-The-Money put.

This strategy is typically employed when the options trader is bearish on the underlying exchange rate over the medium term but is neutral to mildly bearish in the near term.

Alternatively, on speculative grounds, as there is very short term buying trend, we see opportunities in writing OTM calls while dubious traders hold spot outrights.