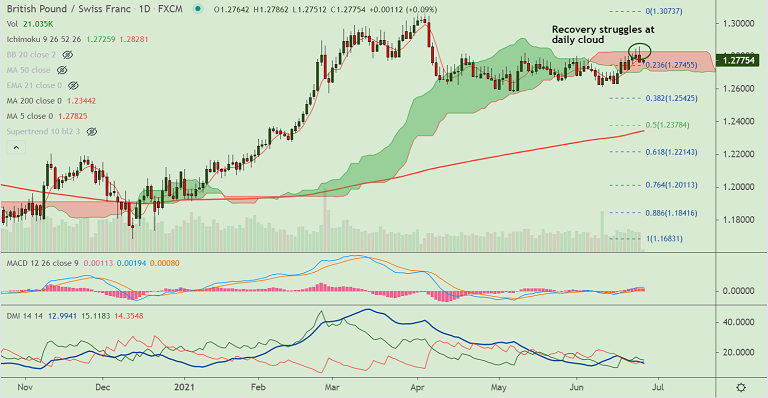

GBP/CHF chart - Trading View

Spot Analysis:

GBP/CHF trades 0.11% higher on the day at 1.2778 at around 04:15 GMT

Previous Week's High/ Low: 1.2798/ 1.2630

Previous Session's High/ Low: 1.2856/ 1.2764

Fundamental Overview:

Sterling keeps the lower ground after the Bank of England (BOE) left interest rates and a bond-buying program unchanged, as widely expected in its June meeting.

On the data front, the UK Gfk Consumer Confidence stood at -9 in June, unchanged from the previous month. The data failed to trigger much buying interest in the pound.

As for now, investors are waiting for the UK CBI Distributive Trade for June for impetus.

Technical Analysis:

- Pullback in the pair has held support at 200H MA

- Price action is consolidating above 200W MA

- GMMA indicator shows major and minor trend are bullish on the weekly charts

- Recovery has failed at cloud top, decisive break above required for upside continuation

Summary: GBP/CHF trades inside the daily cloud. Technical bias is bullish and breakout at daily cloud will fuel further gains. 21-EMA is immediate support at 1.2729. Bullish invalidation only below 200W MA (1.2623).