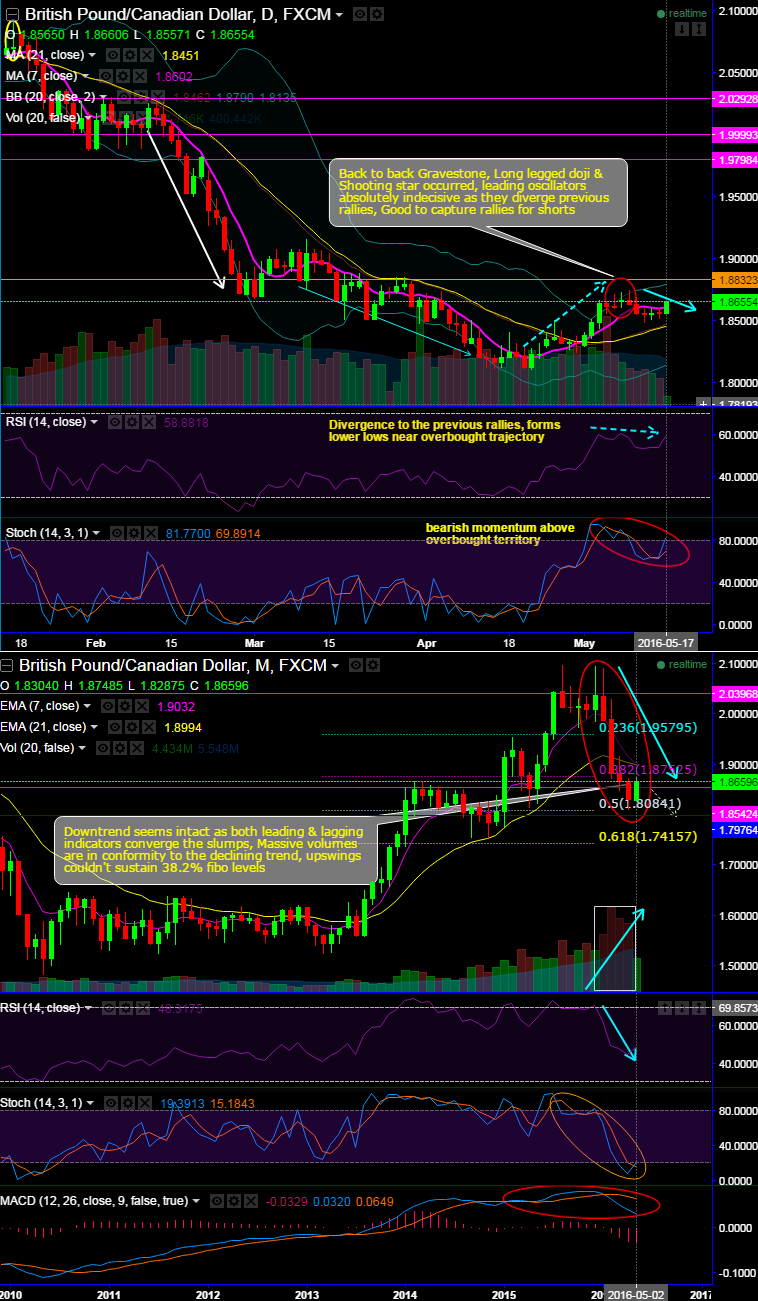

The pair is testing resistance near 1.8672, despite the attempts of upswings in the current prices we reiterate constrained upside potential.

Earlier also the sideway trend slipping as the bears to resume again as stiff resistance seen at 1.8672 & at 1.8823 levels, while RSI & Stoch diverge to previous upswings.

On a broader perspective, the downtrend seems intact as the both leading and lagging indicators converge the ongoing slumps.

It is projected as sideway swings may head towards bearish trend continuation.

Downtrend seems intact as both leading & lagging indicators converge the slumps, Massive volumes are in conformity to the declining trend, upswings couldn't sustain 38.2% fibo levels.

Since, divergence of leading oscillator (RSI) is observed when prices were rallying at this stage on daily plotting, the intraday trend has been stiff at these levels right now but one can get benefitted from the boundary binary options as the leading indicators suggest contraction in ongoing buying momentum.

Thus, it is good to buy boundary binary options with upper strikes at 1.8725 and lower strikes at 1.8550 for minimum targets of 50-60 pips on either sides, use 1H expiries to fetch desired results.