Glimpse on UK Fundamentals:

We continue to maintain our bearish stances as the ongoing downtrend to prevail further ahead of today’s economic numbers such as BoE’s inflation report, PPI and preliminary GDP QoQ.

The recent manufacturing, construction & service PMIs of UK were quite disappointing, CAD is cushioned by rising and stabilized crude oil prices.

GBP OTC FX updates:

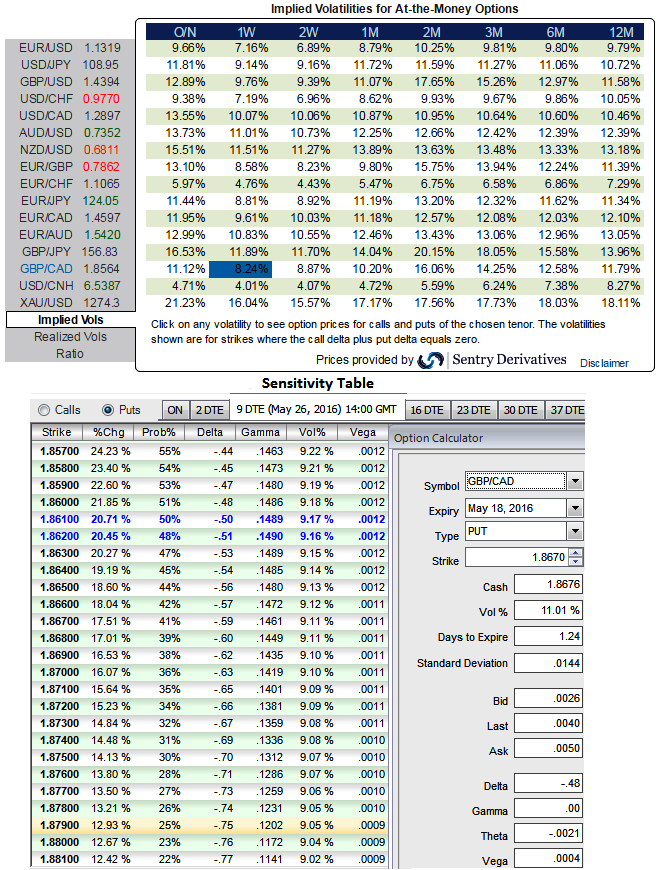

1W GBPCAD ATM implied volatilities have been just shy below 8.25% (the least among G7 currency pairs) which in turn a cause of concern as to whether spot FX would move in sync with vols or not.

Technically, from last couple of days, the pair has been moving in stiff range with upper brackets of 1.8725 and lower brackets of 1.85 levels.

Option trade recommendation: Naked Strangle Sale

As we foresee narrow range trend is puzzling this pair on both intraday and weekly charts.

At current spot at 1.8667, the pair moving in non-directional trend and with stagnant IVs, so, stay short in 3D OTM put (1% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1.5% strike referring upper cap) (preferably short term for maturity is desired).

When investor ponders over the underlying market will not be very volatile within a broader band. No margin is required. Although maximum returns from this strategy is limited to the extent of premiums received on two sides but is certain when the underlying spot FX price on expiry is trading between the OTM strikes as both the instruments have to expire worthless.

Maximum risk is also unlimited, should the market fall or rise dramatically.

If the market does little then the value of the position will benefit as the short positions gain when the option time value falls.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX