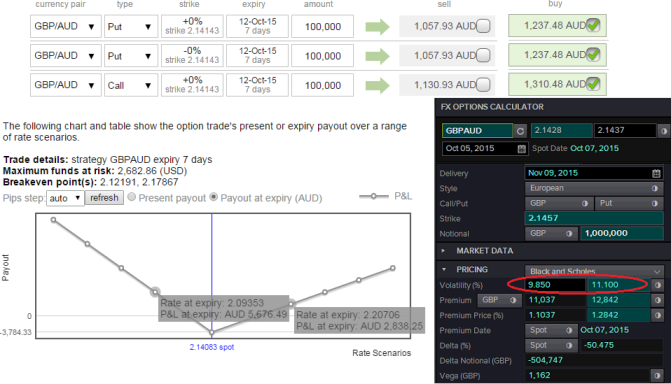

The potential target on upside is about 50-100 pips where 200-250 pips on downside, options strips are to be deployed, now have a look at the diagram fro prevailing prices of ATM puts and they are moving in line with healthy delta. First and foremost considering the prevailing downtrend and the lower implied volatility of GBPAUD ATM contracts is at 11.11% which is a good sign for option holders. We've been firm to hold on this strategy on hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

The rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

Hold 15D At-The-Money 0.50 delta call and simultaneously hold 1 lot of 1M At-The-Money -0.50 delta put options with positive theta values and one more put option 1M At-The-Money puts after squaring off 1st option.

Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: GBP/AUD long term downside risks can be hedged through option strips

Monday, October 5, 2015 12:13 PM UTC

Editor's Picks

- Market Data

Most Popular