As stated in our earlier post on this pair’s technical lines, bears have extended slumps below 61.8% Fibonacci retracements and major downtrend still seems bearish despite abrupt upswings.

You can refer below weblink for more reading on technicals:

So any price bounces should not be deemed as a recovery in the major downtrend, instead one can capitalize these upswings to deploy fresh short build ups.

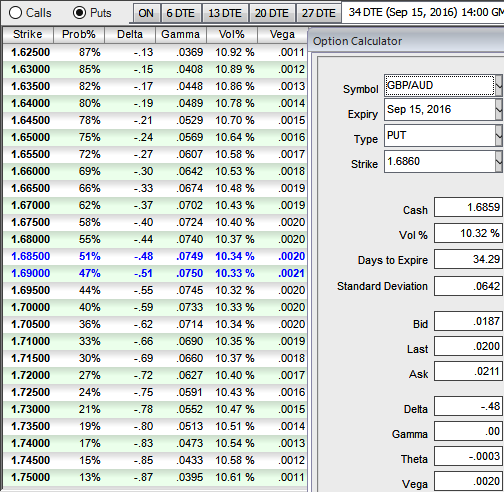

The implied volatility of GBPAUD has been bullish neutral for 1M expiries contemplating risk reversal signals.

At spot ref: 1.6859, go long in 2M/1W/2W GBPAUD put ladder (strikes 1.7667/1.6859/1.6525).

Indicative offer: reduces cost about little more than 50% vs prem for ITM strike only.

The long put ladder is a limited returns and unlimited risk strategy as it proportionately employs more shorts in the spread because the underlying FX pair will experience little volatility in the near term (refer IV and sensitivity table).

Ideally, to execute this strategy, the options trader purchases an (1%) in-the-money delta put, short an at-the-money put and short another (1%) out-of-the-money put of the same expiration date, however this’s not hard and fast, one can choose strikes as per his priorities.

Leaving only 100-125 pips between the former two strikes allows the profile to quickly reach the maximal possible leverage.

Unlike an usual put spread ratio, the maximal return is not reached on a given strike but over a wide region. It maximises the profitability of the trade via increased odds that the spot will trade in this region.

This short vega strategy is also short gamma so that an early spot depreciation will hurt the mark-to-market of the position.

Optimal leverage is only hit at the expiry and premature unwind is unlikely to be attractive before the two-thirds of the trade life.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields