As it is sensed that all chances of Aussie dollar may look superior over GBP in medium term future, we advise to hedge the pound's depreciation over AUD through below recommendations.

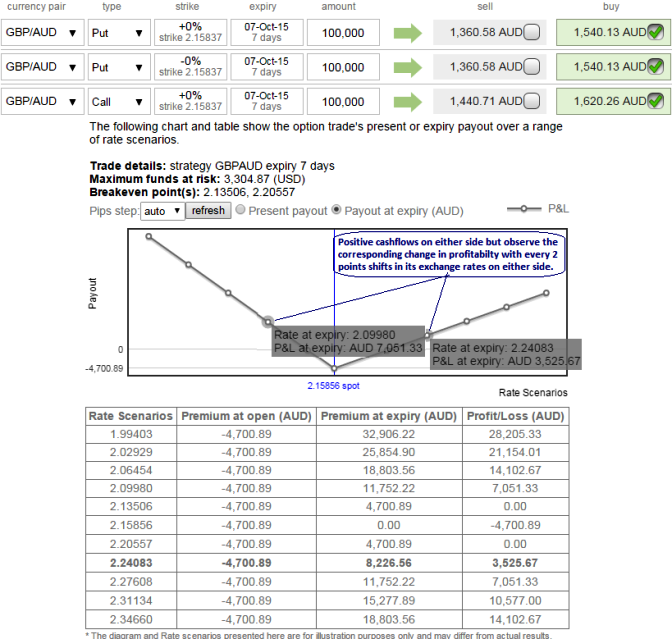

Buy 15D At-The-Money delta call option and simultaneously short 2 lots of 15D At-The-Money put options with positive theta values.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Risk/Reward profile: Since it involves buying a number of ATM calls and double the number of puts. Risk is limited to the price paid to buy the options and reward is unlimited till the expiry of the option.

Please be noted that the trader can still make money even if our above analysis goes wrong - but the pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits. Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy.

Cost of hedging would be Net Premium Paid + brokerage/commission paid.

FxWirePro: GBP/AUD ATM puts in straps on job – convert straps into strips

Wednesday, September 30, 2015 9:00 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings