A few more central banks tiptoe to the exit 2017 was the year in which more central banks broke ranks. We expect this to continue in 2018. The Fed will hike four times and the BoC two, which supports long positions in USD and CAD.

EUR should benefit from the prospect of the ECB completing QE just as it rallied on the expectation of tapering this year.

We pair EUR vs NZD to neutralize the risk to EURUSD from a further repricing of the Fed. The RBNZ is an unlikely candidate to signal tighter policy as the slowdown in migration intensifies the downturn in housing and argues against a policy response to upside inflation risks from minimum wage increase etc. The 3m window KO halves the premium compared to a digital call.

In Sweden, the prospects of a policy pivot were delayed not derailed this year. EURSEK is currently overshooting cyclicals by over 4% the most since 2010. The rebound in inflation to 2.0% in November reduces the risk of the central bank extending QE again next week (this was 0.3% ppt higher than the Riksbank's estimate), although it could still push back the lift-off point for rates by a quarter to 3Q18 in order to better align itself with the ECB’s extension of QE through September.

Long a 9-mo 1.80 EURNZD digital call with a 3m 1.80 window KO. Paid 17.5% on November 21. Marked at 19.04%.

Long a 6m 9.60 EUR put/SEK call. Paid 57.2bp November 21. Revalued at 52bp.

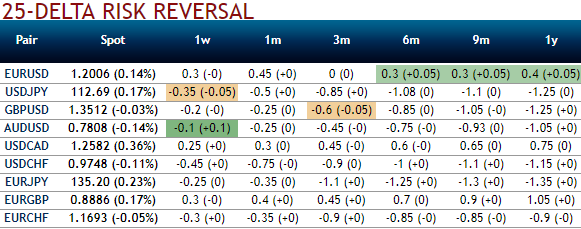

We advocate deploying shorts in futures contracts of near-month tenors with a view to arresting further potential bearish risks of USDCAD, alternatively, we advocate buying USDCAD 3m risk reversal strikes 1.3440/1.2450 (at spot ref: 1.2068).

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action