German industrial production missed the forecasts to disappoint the analysts in Eurozone, actual 0.8% versus forecasts at 0.9%.

Germany posted EUR 21.7 billion trade surplus in July of 2016 against forecasts at 23.2B as exports rose more than imports.

While French industrial production (MoM) has shown a massive dip from the previous -0.5% to the current -0.8%.

Italian trade balance is also no exception to add stress in Eurozone, has declined from the previous 5.03B to the current 4.66B.

German GDP QoQ is scheduled to be announced tomorrow, and it is likely to be contracted to 0.3% from the previous flash of 0.7%.

Technically, with shooting star occurrence on weekly charts of EURCAD, the current prices on intraday charts have slid below 7SMA and 21SMA, and then broken 1.4531 levels with intensified selling interest in this pair but one should cautiously wait for the substance below that level which would bring in more slumps. Hence, we could foresee southward journey, probably below 1.45 sooner.

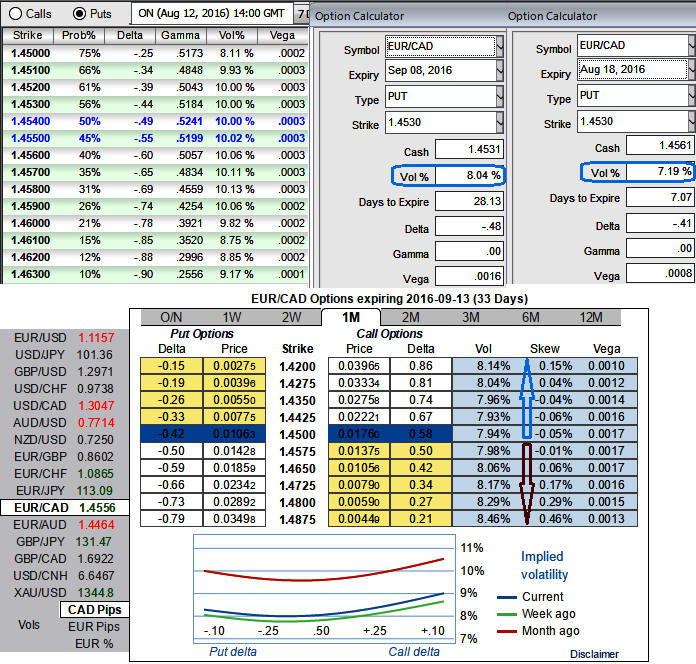

As you can see diagram, the implied volatility of 1m ATM contracts are trending higher than 8.04%, and shy above 7.15%, with skews are equally showing OTC markets interests on either direction.

So, it means that, the FX option market is expecting the underlying EURCAD price to move by 8.04%, either up or down, over a certain time period.

If EURCAD is trading at 1.4549, you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes (see from spot FX 1.4549, as it travels towards OTM strikes, more chances of expiring in the money and huge changes in premiums, so these options pricing seems reasonable, but same is not the case with higher strikes.

Hence, we reckon the delta instruments are more conducive in bearish hedging during such fragile euro conditions.

So, a smart approach to tackle this pair and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts as they are likely to expire in the money with higher probability.

Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. This is achieved by ensuring that the overall delta value of a position is as close to zero as possible. Delta value is one of the Greeks that affect how the price of an option changes.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary