Yellen dropped a heavy hint last week that a rate hike was coming on the Ides of March. That too is the day of the Dutch general election, though it remains unlikely that the populist Party for Freedom will secure a majority of parliamentary seats, especially with recent opinion polls indicating waning support.

US 10-year bond yields have traded to the top of this year’s range, and would need to break through to the upside to get the dollar’s momentum going. USD/JPY continues to be highly sensitive to US bond yields. Another decent US payrolls report this Friday should cement the emerging consensus of a March Fed hike.

After a month of relentless pounding, FX option markets are ending February with front-end vols in USD-pairs on a slightly firmer footing, thanks to what looks like a concerted campaign by Fed officials to nudge the market towards pricing in a March hike. That effort is largely successful judging by the climb in OIS-implied probability of a March move to 90%, but we suspect that markets will additionally test the odds of a rise in the 2017 median dot from the current three hikes to four in the run-up to the meeting.

Gamma in dollar pairs is likely to firm over the next two weeks with the Fed narrative returning as a market driver.

Owning USD-gamma in commodity FX funded with shorts in select yen crosses (EURJPY, CHFJPY) is a reasonable RV orientation.

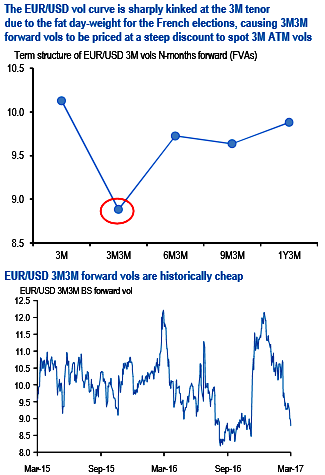

EURUSD 3M3MFVAs are asymmetric French election hedges given their steep discount to event premium-heavy 3M ATM vols and attractive entry levels. -3M/+6M calendar spreads of EUR calls/JPY puts are worth tracking as post-election reflation plays given vol curve inversion beyond 3M expiries.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise