After a month of relentless pounding, FX option markets are ending February with front-end vols in USD-pairs on a slightly firmer footing, thanks to what looks like a concerted campaign by Fed officials to nudge the market towards pricing in a March hike. That effort is largely successful judging by the climb in OIS-implied probability of a March move to 90%, but we suspect that markets will additionally test the odds of a rise in the 2017 median dot from the current three hikes to four in the run-up to the meeting.

If so, this week’s snappy dollar rally can extend over the next two weeks, but there is a palpable risk of disappointment should stretch-expectations of a dot-plot upgrade prove optimistic.

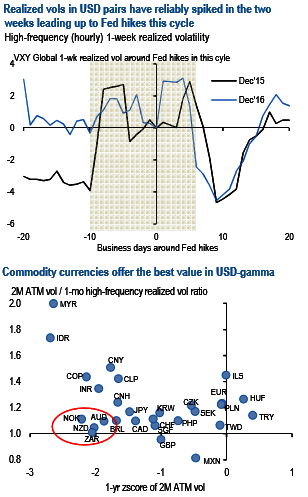

Either way, the dollar narrative is back in play after a subdued start to the year and realized vols in USD-pairs are liable to firm in coming weeks much as they have done around the last two Fed meetings that featured rate increases this cycle (refer above chart).

At current market, the best value gamma in USD pairs is to be found in the commodity currencies – AUD, NZD, NOK, ZAR and MXN – where not only are implied vols historically low and implied/realized vol ratios suitably depressed (refer above chart) but also cash valuations are screening rich in many cases after their breakneck YTD rally and susceptible to further correction from recent highs. Additionally, AUD and NZD bloc vols have been relative outperformers vis-à-vis other currencies over the past month (refer above chart) and have the advantage of return momentum tailwind behind them.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady