The US Federal Reserve cut its policy rate by 25bp to a range midpoint of 1.625% - its third consecutive reduction, and widely expected. Its statement on the outlook did not signal further cuts but retained the optionality to do so. The statement was largely a copy of September’s, with the main change being the removal of the phrase “act as appropriate”, saying instead it will “assess the appropriate path….”. Rosengren and George dissented. In his press conference, Chair Powell characterised the cut as insurance to maintain economic strength and said the policy stance is appropriate given known information.

NZDUSD has been attempting to bounce from the last couple of months, jumped from the September lows of 0.6203 levels to the current 0.6407 levels.

Though the pair seems to be volatile for today, but the potential to test 0.6400 in a day or two is possible. The Fed’s rate cut is perceived as a major catalyst for NZD’s upside traction.

Kiwis in the medium term perspectives: The recent gains in NZDUSD could extend to the 0.6500 area in the near terms. NZ inflation and housing data has been firmer than expected, and meat and dairy prices have risen. In addition, the USD has softened, and speculator positioning remains extremely short NZD.

However, we remain bearish stances, targeting 0.62 area, as the global trade tensions persist and global growth weakens further.

OTC Updates and Options Strategy:

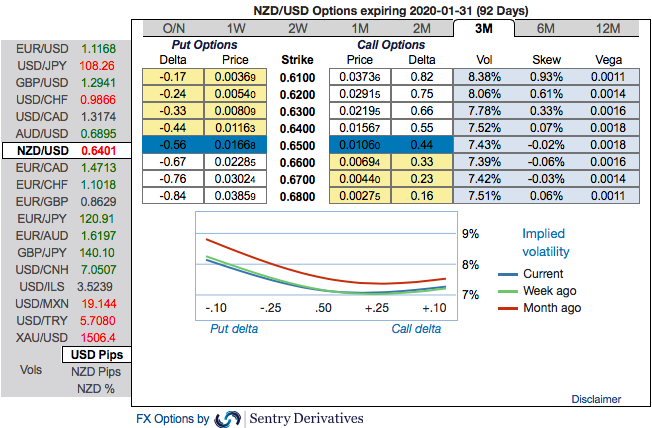

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing shrinking IVs among G10 FX bloc (1m IVs are at 6.9. in comparison with 3-6m IVs which are above 7%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Most importantly, positively skewed 3m IVs advocate both upside and downside risks.

Contemplating above fundamental factors and OTC outlook, diagonal debit put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

On trading grounds, executing below options strategy as IVs are most likely to favor. Courtesy: Sentry & Westpac

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures