The Bank of Canada (BoC) would likely take a break in its hiking cycle today. The concerns surrounding the NAFTA negotiations are too great, especially after the saber-rattling in the USA has increased massively recently.

As the economic outlook for Canada could deteriorate significantly if the negotiations fail, the BoC will remain cautious for the time being.

The uncertainty about the economic outlook, that justified the previous rate hikes, is high due to the concerns about the NAFTA negotiations. In particular, the economies of Mexico and Canada would suffer as a result of a trade war with the US.

The recently more aggressive tone from the US and the uncertain outcome of the negotiations are likely to prevent the BoC from hiking its key rate further for now. CAD would, therefore, lose out against the USD in the current situation in the near future.

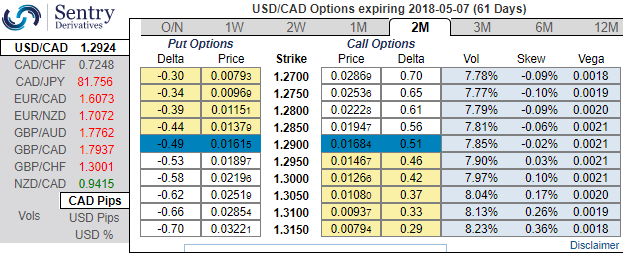

As a result, we could evidently spot this out in OTC indications of CAD crosses. In the above nutshell, we’ve predominantly chosen CAD crosses that signifies the mounting hedgers’ interests for bearish risks in USDCAD, EURCAD, and CADJPY. The positively skewed implied volatilities are in tandem with our extrapolation on CAD as stated above.

While risk reversals of USDCAD are also indicating the similar sentiment ahead of BoC monetary policy meeting that is most likely to maintain status quo.

Rate hikes hopes were imminent so far, as the Canadian economy continues to grow at a respectable rate and well above the potential growth rate assumed by the BoC. Moreover, at 1.7%, inflation is within the BoC's target range (refer above chart) and the unemployment rate has reached the same historic lows as before the financial crisis, which should speak for rising wages in the medium term (refer above chart).

Nevertheless, the BoC will not take action this time and prefer to wait and watch approach on a view to the NAFTA negotiations, which have become much more explosive in view of the announcement of new import duties by US President Donald Trump. The tone of the U. S. becomes sharper, a trade war and failure of the NAFTA negotiations can no longer be ruled out.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data