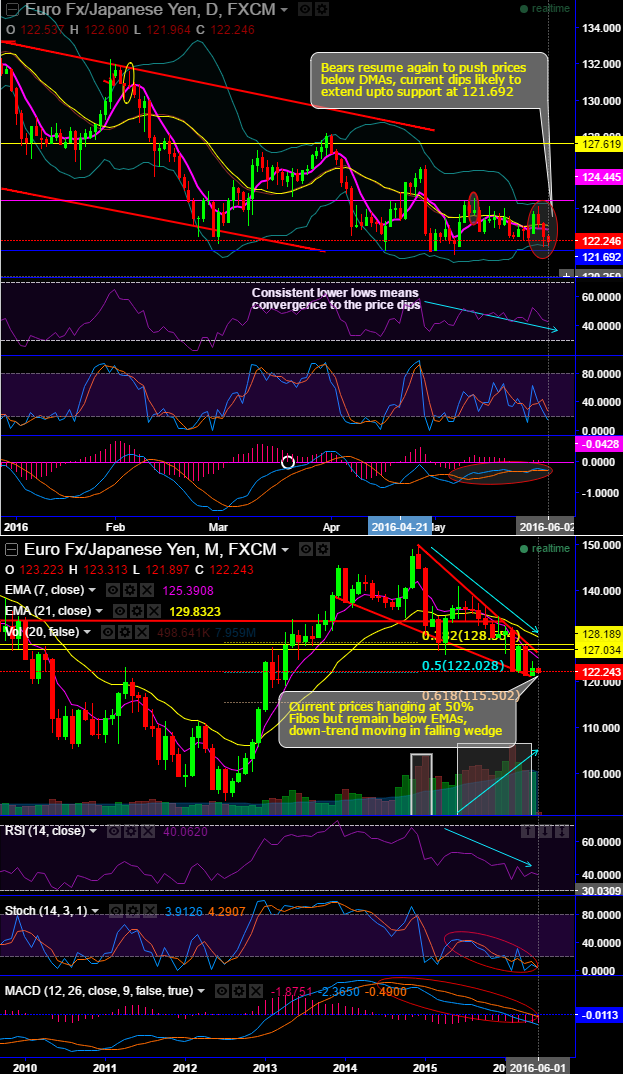

Bears have managed to push prices southwards below DMAs after 3 weeks of whipsaws on DMAs (daily charts).

The current dips are intensified as the momentum is confirmed by leading oscillators at the moment.

Bears resume again on "Shooting Star" occurrence at resistance of 124.445, current prices tested support at 123.55 but still below DMAs.

On a broader perspective, Current prices hanging at 50% Fibos but remain below EMAs; major downtrend has been slipping through falling wedge and bulls have tested supports at wedge baseline (see monthly charts).

Most notably, volumes are in conformity to the major downtrend - See huge volumes on dipping prices.

Leading oscillators has been converging to the major downtrend.

MACD with bearish crossover has just entered into zero levels which is bearish territory.

This month, the pair tested supported near 122.028 levels (Wedge base & 50% Fibo levels) but we could now foresee all chances of failure swings and break below these levels.

So, we view the current price rallies as momentary gains as the major downtrend offers more shorting opportunities.

Option Trade Tips:

Capitalizing on these deceptive rallies, you decide to initiate a bull put spread at net credits when IVs are reducing which is good news for option writers. We had advocated below option strategy 2 weeks ago,

Short in 3D (-1%) in the money put with positive theta and simultaneously, buy 2W at the money -0.5 delta put option.

We're quite sure that yields on shorts are certain, long side is performing along with the ongoing price declines and more to go in the days to come.