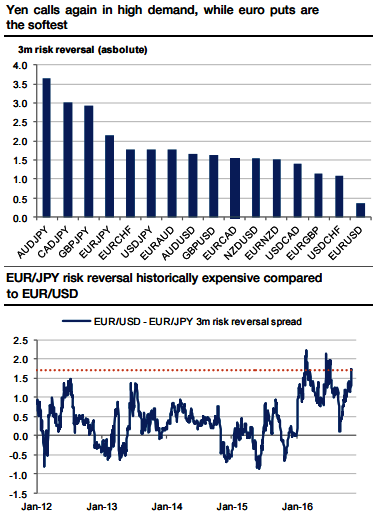

The excessive yen skew premium Yen calls are in high demand for all crosses (see above graph) as the market is behaving in a risk-off way. As we wrote here and here, the yen probably met an inflexion point after months of strength.

It is bid this week just ahead of the election, but a Clinton victory remains the central scenario and would provide immediate relief.

A Trump victory would pressure the USDJPY towards 100 but a break would not at all be to the BoJ’s taste, whereas the Fed is edging closer to a December hike, making a new rebound likely. Selling outright yen volatility or skew is not a reasonable trade given the imminent risk event, but selling the yen skew premium as a leg of a relative value trade appeals.

Stay short EURJPY rather than USDJPY skew, the EURJPY 3m skew is larger than the USDJPY skew (-2.1 vs -1.8), so that selling the former provides a higher premium.

Moreover, the EURJPY skew exceeding the USDJPY is not consistent in times of EUR topside volatility. On the contrary, euro bullishness should dampen the EURJPY skew, which is, therefore, an attractive Sell.

The spread between EURJPY and EURUSD 3m risk reversals is now very elevated historically, as it is exceeding 1.5 vols (see above graphs).

It never happened between 2012 and 2015 and such a situation happened only very transitorily this year. We expect the gap between EURJPY and EURUSD skews to tighten.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures