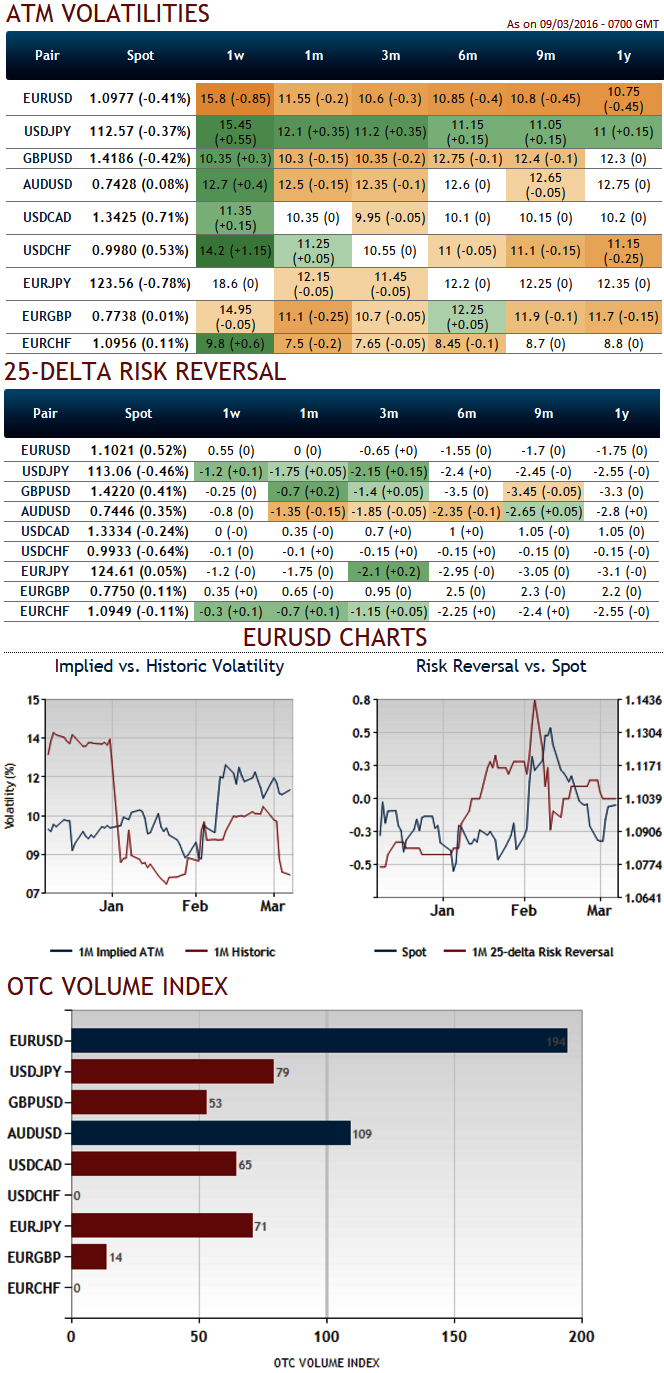

The implied volatility of ATM contracts for 1M-3M expiries of this the pair is ranging from 10.5-12%.

Delta risk reversals with positive ticks creeping up gradually for next 1W expiries to signify the hedging positions are well equipped for any abrupt upside risks and downside hedging arrangements over the longer period of time.

From almost last one year we've been seeing the pair oscillating within stiff sideway trend (ranging 1.1480 to 1.05 levels).

If you consider long term euro's valuations then you would come across the convergence between spot curve and risk reversals (see spot/risk reversal relation in the diagram).

While current IVs of ATM contracts of euro crosses for 1W expiries acting crazily (EURUSD almost at 15.8%).

1M-3M expiries have been lingering around 11-12% which is at higher levels but favours bears in long run. And you can also observe at current juncture IVs acting dramatically with historical vols.

This disparity is majorly because bears lined as Euro retreaded below 1.0976 levels, many turned a sceptical eye to Thursday's crucial meeting of the ECB.

The euro has started the trading week with minor gains, as the pair trades at the 1.1060 on 8th March began tumbling.

The 19-country central bank is expected to lop a key rate further below zero while it may also opt for a longer and larger QE bond-buying program that aims to juice the economy by anchoring interest rates to spur faster borrowing and spending.

Technically, the pair has rejected at important resistance at 1.1060 levels by forming Shooting star candle to slip below 21DMA curve.

It is currently hanging around supports again at 1.0976 levels with leading oscillators to diverge the previous rallies.

Since, OTC market signals and technicals upside potential upto 1.1060, any unexpected swings should only be read as shorting opportunities for formulating downside hedging strategies.

So, the strategy goes this way short 1W OTM striking puts, while double the size of longs in ATM and ITM strikes of 50% deltas and 3M tenors.

FxWirePro: Euro's divergence between HVs and IVs but convergence between spot and RR, EUR/USD hedging as per OTC adjustments

Wednesday, March 9, 2016 9:56 AM UTC

Editor's Picks

- Market Data

Most Popular