EUR vols appear to be at opportune levels for a fresh stab as a European politics hedge.

Owning protection against European political discontent has been a key pillar of our bullish vol stance since late last year. Recent political developments in France and the implosion of what was considered to be a comfortable status quo (Fill on as one of the two run-off candidates) has reignited focus on political risks in the continent. EURUSD vols do not reflect this increased anxiety, however, having dipped 1.5 -2.0 vols across the curve from their December highs (refer above chart).

Even though the probability of a catastrophic electoral outcome in France is low in our mind, the fact that EURUSD carries little-to-no risk premium for a Le Penn shock - short-term fair value models indicate that the currency trades about three cents stronger than Euro-US rate differentials and sovereign spreads would justify – is disconcerting; nor is positioning extreme short enough to suggest sufficient investor preparedness for a tail result (we would run you through on hedging perspectives in our upcoming write-up ahead of French political risk in rates, FX & commodities).

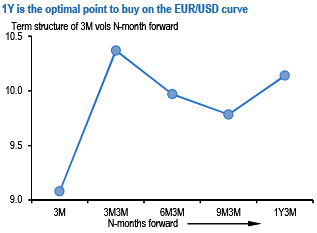

Softness in Euro vols is in line with this overall complacency, and perhaps reflects the offset of a weaker dollar as the latter’s reserve currency status comes under the microscope in a hostile environment for free trade and open borders. Odds are decent that this oversight will fade as the actual event draws closer, and current sub-10 levels on 1Y ATM vol strike us a good risk reward to start legging into or adding to existing vega longs. Along the lines of the USDJPY set-up earlier, 1Y is the optimal point to buy on the curve (see above chart); we are currently long an aged 1Y straddle in the portfolio.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary