A backdrop of Euro zone political risk will remain a key focus for 2017. Little adverse market impact has so far been seen from Italy’s rejection of constitutional reform in December’s referendum.

Europe faced one constitutional referendum (Italy in December) and three to four national elections next year:

Netherlands in March, France in April/May, Germany by October and possibly Italy.

There are good reasons to think that eventual ballot box outcomes will buck the current populist trend and turn out Euro-benign.

Markets are mindful of potentially bigger risks to come in Dutch, French and German elections that would tie more neatly with the narrative of a rise of anti-globalist populism – not least in light of December’s terrorist attack in Berlin.

Meanwhile, Italy’s proposed €6.6bn recapitalisation of Monte dei Paschi di Siena, its third-biggest bank – as part of a bigger €20bn bailout fund for the banking sector – confirms the substance in concerns around the solvency of Euro zone periphery banks and governments.

Seen in that light, the uneven benefit of the ECB’s monetary stimulus argues against its premature withdrawal, as do inflation dynamics at the aggregate Euro zone level.

‘Flash’ data for December (Wed) are likely to show a rise in headline inflation to 1.0% y/y, reflecting favorable energy base effects, but underlying ‘core’ inflation remains weak – suggesting the likelihood of a loose monetary stance for an extended period.

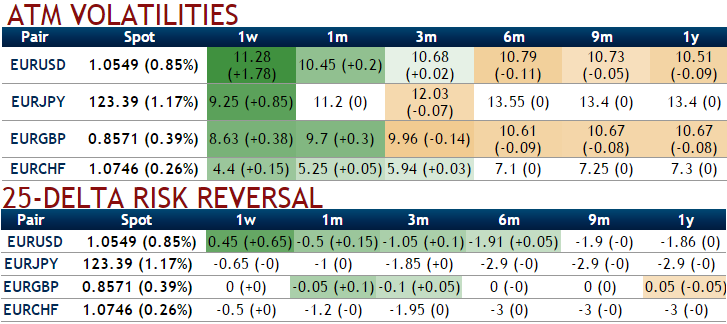

You see higher and steeper 1m-3m EUR vols: you could make this out from the IV nutshell with rising hedging interests during this span.

Europe faced one constitutional referendum (Italy in December) and three to four national elections next year:

Netherlands in March, France in April/May, Germany by October and possibly Italy.

There are good reasons to think that eventual ballot box outcomes will buck the current populist trend and turn out Euro-benign.

Trump shock will now pull forward that time table, lift 6M-1Y expiry EUR vols that span European election dates, and bull-steepen the vol curve even if shorter- expiry implieds remain well-anchored by tight ranges on spot Euro.