After ECB's deliverance of more than anticipated has not completely priced in. All FX, equity, bonds and derivatives markets seem to be adjusting. You can observe that from the IV and RR nutshell.

Had the ECB announced a little less and spaced out the moves taken across different meetings -- while at the same time signalling that more action could be taken in the future -- EUR/USD would have probably crashed.

But the ECB failed in forward guidance. The ECB singled out trigger points for economic measures and hinted the streets with no more policy easing.

Instead, it could have made this way as in always potential measures can be brought in when conditions warrant it, but it is now deemed as more stimulus is not probable in near future.

Hence, at least the next 2 to 3 months, there wouldn't be any abrupt or potential policy action from the central bank whenever is needed. This would lead us that the market was short euros after the rate decision, its shift to a quasi-neutral monetary policy stance after easing triggered a wave of short covering.

This significant leading macroeconomic indicator divulges economic struggle and how the businesses adopts quickly to market conditions has been the biggest challenge, and their purchasing managers probably hold perhaps the most current and relevant insight into the company's view of the economy.

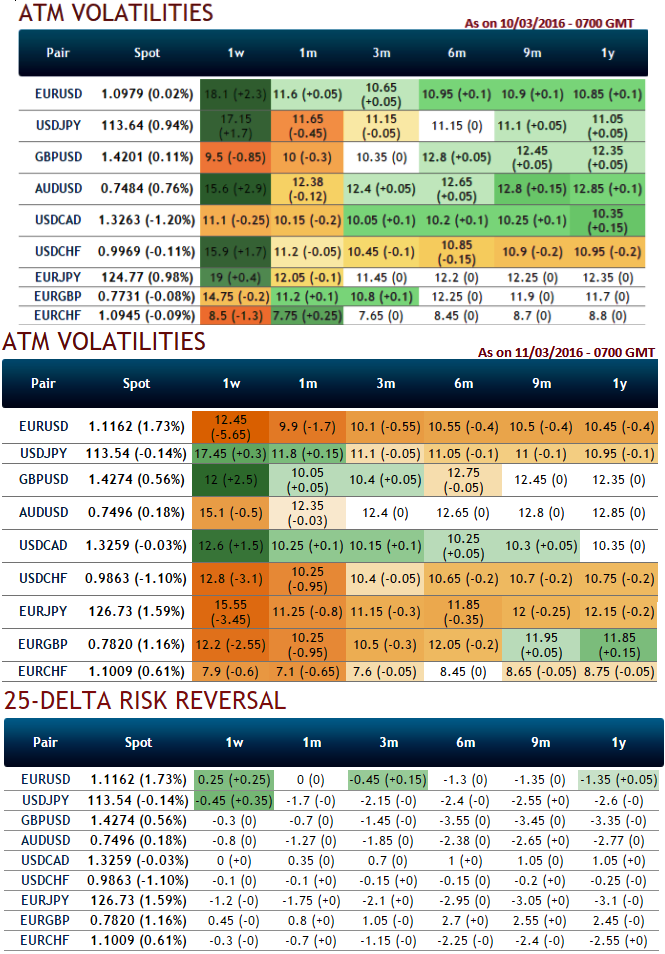

Options holders, those who want to initiate the fresh longs, please be mindful of ATM IVs, risk reversals and OTC order flow analysis and compare that with your returns objectives and risk appetite:

The implied volatility of ATM contracts for 1W expiries of all euro crosses have shrunk away soon after yesterday's event.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for euro's upside risks over the period of time.

FxWirePro: Euro IVs drastic cooling off owing to ECB's failure in forward guidance

Friday, March 11, 2016 10:35 AM UTC

Editor's Picks

- Market Data

Most Popular