Well..! It's not a miracle but sheer research and mere effects of bearish pattern that we spotted out in our earlier post.

So, before proceeding further please refer below link as to understand on how the hanging man pattern evidenced their bearish effects recently and rest all is history for now.

http://www.econotimes.com/FxWirePro-Hanging-man-formation-signifies-NZD-JPYs-weakness-likely-to-retest-support-at-80250-110353

We don't think any further justification is needed after referring our previous post.

But for now we think that the pair seems unlikely to sustain previous crucial supports at 80.250 levels.

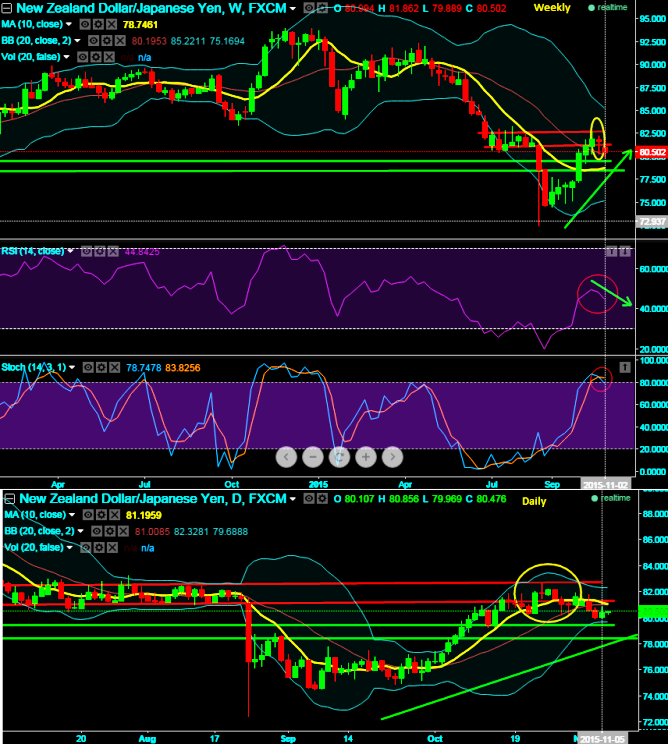

On daily charts, the prices have slipped below 10DMA that signifies us prolong prevailing bearish sentiments after breaking supports at 81.005 levels.

On weekly chart also it is maintaining the bearish attitude well below this support level with 1 day to go to form a weekly candle way below 81.005 followed by hanging man pattern which is a clear confirmation for bears.

The RSI oscillator has begun diverging at around 50 levels to the previous rallies (see circled area on RSI curve) which is one more confirmation of potential bearish swings.

Subsequently, Stochastic remains in overbought territory despite an attempt of bearish crossover, %D line crossover above 80's, this intensifies bears interests in the market, as a result we've seen today's lows at 81.005 to break the above support zone.

Hence, next strong support is seen only at 79.495 levels, if the pair does not manage to hold onto this level that would certainly expose the levels of 78.330 in short term.

Although the pair experiences some bounces, we could see with dubious eyes on Kiwi fundamentals which are not that conducive, as a result, we maintain long term bearish trend in our opinion.

FxWirePro: Efficient functioning of “hanging man likely to drag NZD/JPY to 78.610 on support breach at 81.005

Friday, November 6, 2015 5:21 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?