Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.18949

Kijun-Sen- 1.18494

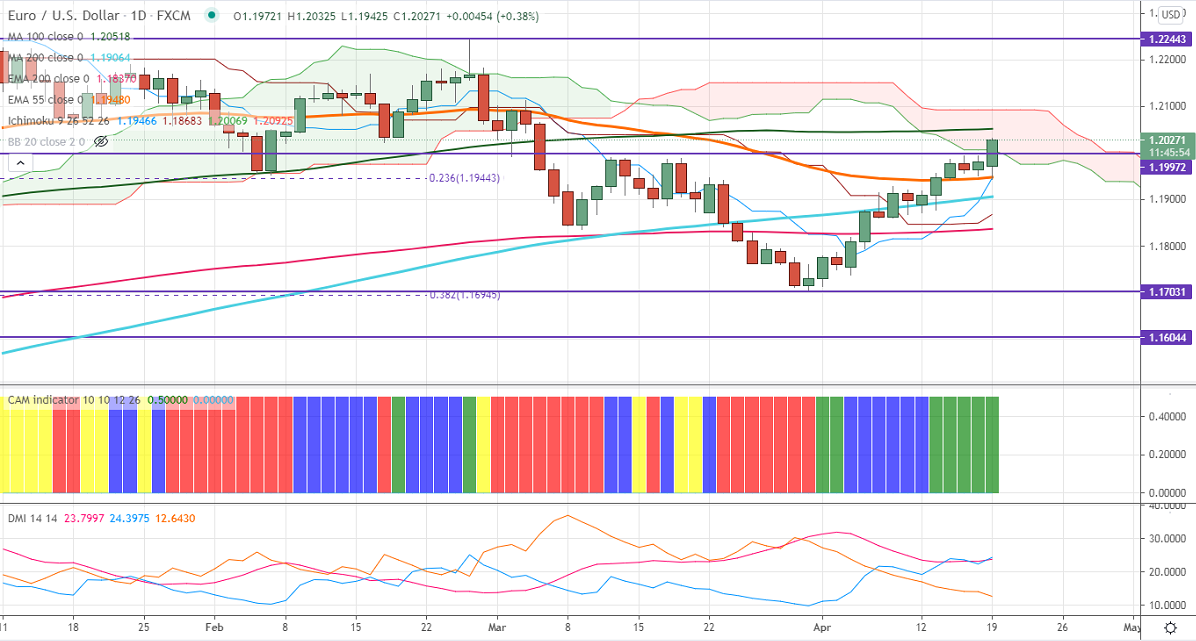

EURUSD surged more than 70 pips in the European session on broad-based US dollar selling. The upbeat market mood and fast vaccination in Europe are supporting the pair at lower levels. The slight sell-off in US bond yields is dragging the US dollar index further lower. DXY has broken significant support 91.50, a dip till 90.60 likely. US 10-year yield lost more than 14% from temporary top 1.774%.dollar at lower levels. US retail sales data surged to 9.8% in Mar compared to a forecast of 5.8%. The number of people who have filed for unemployment benefits declined to 576k in the previous week compared to an estimate of 703K. US 10- year yield lost more than 9.% this week and is hovering near 1.58%

DXY is trading below 92 levels; markets eye 91.50 for further bearishness. EURUSD hits an intraday low of 1.19504 and is currently trading around 1.19752.

Technical:

The pair is facing strong support at 1.2000. Any break below confirms minor bearishness, a dip till 1.1950/1.1900 likely. The near-term resistance is around 1.20480. An indicative breach above will take the pair to next level till 1.2100/1.2150. Short-term trend reversal only above 1.2350.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2000 with SL around 1.1950 for the TP of 1.2100.