Technical Purview:

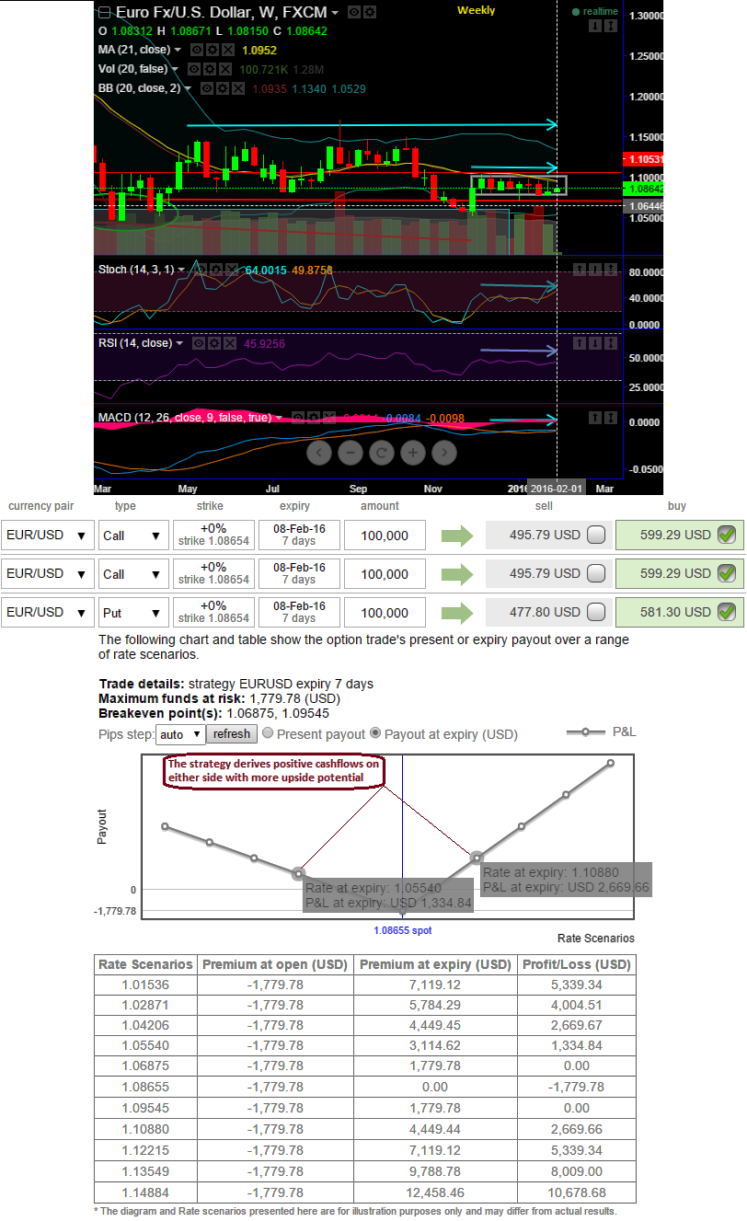

It has been observed and kept urging that there would remain in the range bounded trend on this pair where upper band is 1.1050 and 1.0710 from last couple of weeks ( see grey shaded areas), and same is the case with daily charts price fluctuation shows whipsaws at 21DMA, even on weekly charts prices curve has been hovering below 21DMA consistently.

In between, the pair has also made an intermediary channel between 1.1050 and 1.0710 where it has acted as resistance and support several times in the past. While leading and lagging indicators moving linear direction which is converging this range bounded movement.

As we saw in our recent risk reversal computation, we may see little upside movements but within next 1 month or so, certainly not in a long run.

Hence, contemplating all these aspects we would anticipate USD on weaker side on the back of last week's rise in jobless claims which has flashed at 278K although well in line with forecasts but increased pressures from China. As a result of above technical reasoning we see pair to head slightly upwards fro next fortnight or so but southwards in long run to reach back lower channel again.

Currency Hedging Strategy:

As a result, we recommend building portfolio with longs positions in 2 lots of 3W ATM 0.51 delta calls and 1 lot 1W of ATM -0.49 delta puts for net debit. (The identical expiries used in the diagram is meant for demonstrated purpose and P&L profile only).

Hence, this EURUSD option strips strategy should take care of any abrupt upswings in short term and certain downswings and yields handsome returns on the downside in long term.

Delta of far OTM options is very small which is why we've chosen ATM instrument on call. A 1-point movement in underling pair will not have much effect on the option premium.

Rules to be followed while deploying option straps strategy:

Choose your preferred underlying spot FX price range but that's an individual preference.

Exit within two weeks after the desired result from the strategy, never hold into the final stage of expiry. During the final month, your options will suffer increasing time decay, which we don't want to be exposed to.

FxWirePro: EUR/USD whipsaws 21DMA. likely to remain in range 1.1050 – 1.0710 – use calendar option straps for hedging

Monday, February 1, 2016 12:09 PM UTC

Editor's Picks

- Market Data

Most Popular