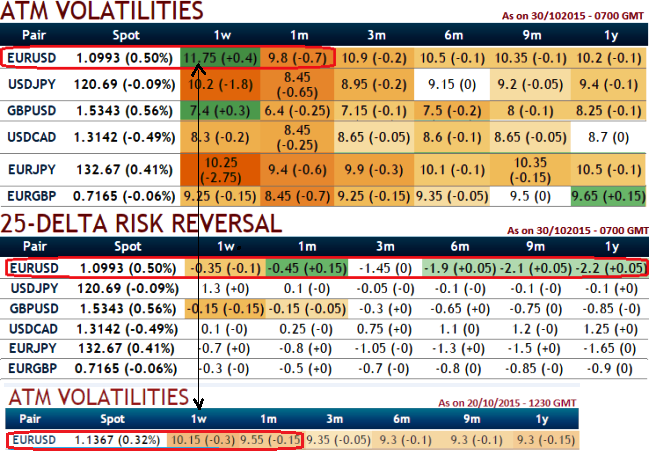

Please have a look at ATM vols and risk reversal nutshell from last week to the current situations. EURUSD still maintains the highest place for implied volatility of 1W at the money contracts among G7 currency space, almost nearing 12%, certainly rising higher which is favorable for those look for option writings.

We kept urging quite often the rosy opportunities for bears when spot FX of EURUSD was at 1.1379, we could now see all chances of retesting 1.0799 levels as the delta risk reversal for 1m contracts have shown bearish signals back again and long term (1M-1Y) put contracts are also on higher demand.

However, as a reminder, this higher IV represents how much movement today's FX market expects from EURUSD during US sessions and the life span of the option. In that respect, an option buyer is partially buying the market's expectations for this pair.

More importantly, the contracts of this pair for 3m-1y expiries show drastic increase in negative sentiments. So, from this computation what we could interpret is that EUR may eye on minor gains in short run but any given point in time dollar's appreciation as quite certain event on improving macro numbers in U.S and accordingly a Fed's rate decision.

Compare the ATM vols of last week with current vols they indicate writers will have competitive advantage and in addition risk reversals reveals also adds negative sentiments, as a result hedging activities using ATM puts are increasing which in turn led to the overpriced premiums.

FxWirePro: EUR/USD highest IV among G7 space, risk reversal bearish sentiments – writers to capitalize on upswings

Friday, October 30, 2015 9:46 AM UTC

Editor's Picks

- Market Data

Most Popular

7