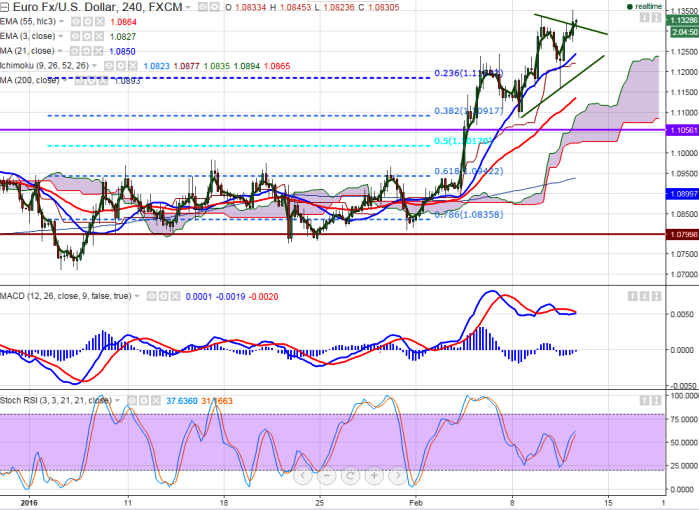

The pair has retreated after making a high of 1.1356 at the time of writing. It is currently trading around 1.13190.

- Short term trend is bullish as long as support 1.1250 holds.

- On the lower side major support is around 1.1250 and break below targets 1.1180/1.1100/1.1050 level.

- The pair's further bullishness can be seen only above 1.1350 and break above targets 1.1385/1.1430.

It is good to buy at dips around 1.1285-90 with SL around 1.1245 for the TP of 1.1350/1.1385.