Background: FOMC tiptoes toward December, Fed officials have done little to persuade the markets that a hike is imminent and we believe the FOMC has little appetite to deliver a surprise. As a result, we think the Fed is unlikely to act next week.

The meeting should, however, prepare the ground for a rate hike in December. The statement’s description of recent economic developments “expanding at a moderate pace” is unlikely to undergo significant changes.

Consequently, the short-term volatility is likely to benefit the USD - Diverging monetary policy indicates a weaker dollar. We see a next Fed hike in December and three hikes in 2017. The ECB is likely to cut the deposit rate to -0.6% and increase its asset purchases.

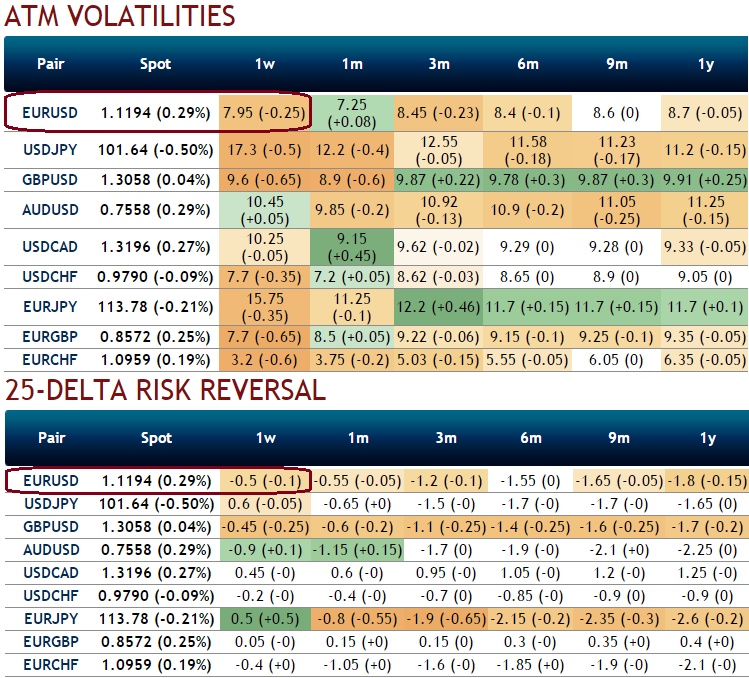

While current IVs of 1W ATM contracts of EURUSD are crawling reluctantly a tad below 8%, a massive drop from recent times, as a result option premiums likely to shrink away on account of time decay.

The pair’s risk-reversals should be pressured further to align with the impulsive retracement in spot.

Data radar: US building permits (Tuesday) expected to show increase, FOMC statement and funds rate decision (Wednesday), US unemployment claims (Thursday) to flash unchanged numbers, yet jobless numbers to slightly increase from 260k to 261K.

We advise below option strategy so as to monitor the turbulent spot FX swings on account of above fundamental events in this week.

Option Strategy:

Well, if you are perceiving the pair’s non-directional trend is likely to prevail, then the strategy goes this way for you, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit, all strikes should have similar tenors.

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral to slightly bearish risk reversal sentiments, accordingly we construct the multiple legs of option strategy for regular traders of this currency cross when there is little IV.

For the total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook