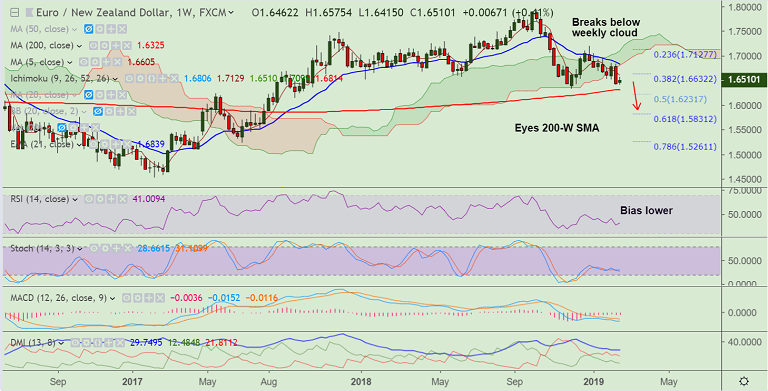

EUR/NZD chart on Trading View used for analysis

- EUR/NZD is trading 0.34% higher on the day at 1.6528 at 0910 GMT.

- The pair is in a major downtrend and recovery attempts were capped at 55-EMA.

- Positive developments in U.S.-China trade negotiations helped risk sentiment and along with it the single currency.

- Major trend in the pair is bearish. We see stiff resistance at 1.6530. Break above can see upside till 1.66.

- We recommend going short on upticks. Scope for test of 200-W SMA at 1.6325. Bearish invalidation only above 55-EMA 1.6755.

- Outgoing ECB chief economist, Peter Praet in a speech earlier today said that normalisation of central bank instruments is not akin to policy tightening.

- Paret said that the ECB will not necessarily take TLRO decision in the next meeting. He added that quantitative easing (QE) is still part of the toolbox.

- Markets now await eurozone flash consumer confidence index due later in the day.

Support levels - 1.6494 (5-DMA), 1.64, 1.6325

Resistance levels - 1.6530 (1H 110-EMA and 2H 55-EMA), 1.6608 (5-W SMA), 1.6641 (21-EMA)

Recommendation: Good to stay short on rallies, SL: 1.6610, TP: 1.6325

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.