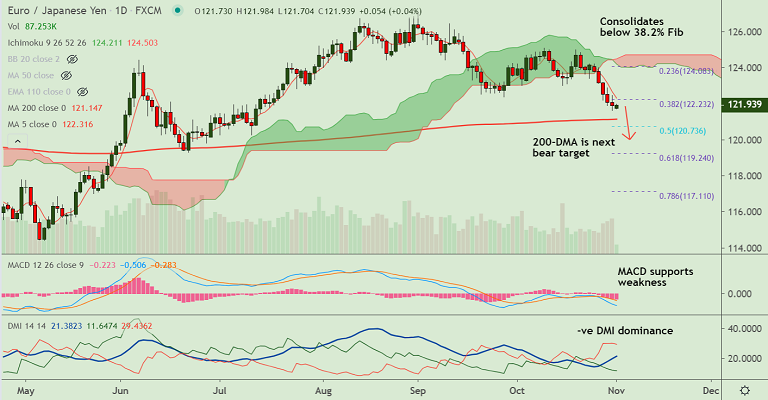

EUR/JPY chart - Trading View

EUR/JPY was trading largely unchanged at 121.86 at around 07:35 GMT, scope for downside resumption.

The pair has paused 5 straight sessions of downside, some dip-buying seen with receding demand for the safe-haven JPY.

Continued widening of the US-German bond yield differential is likely to weigh on the single currency and cap recovery.

Technical indicators support weakness. Analysis of GMMA indicator shows minor trend is strongly bearish.

Price action is below cloud and major EMAs. Volatility is rising and strong bearish momentum is likely to drag prices lower.

200-DMA is major support at 121.14. Break below required for further weakness. Next major bear target lies at 61.8% Fib at 119.24.

On the flipside, 5-DMA is immediate resistance at 122.32. Bearish invalidation only above daily cloud.

Support levels - 121.14 (200-DMA), 120.73 (50% Fib), 119.24 (61.8% Fib)

Resistance levels - 122.32 (5-DMA), 123.06 (110-EMA), 123.36 (21-EMA)