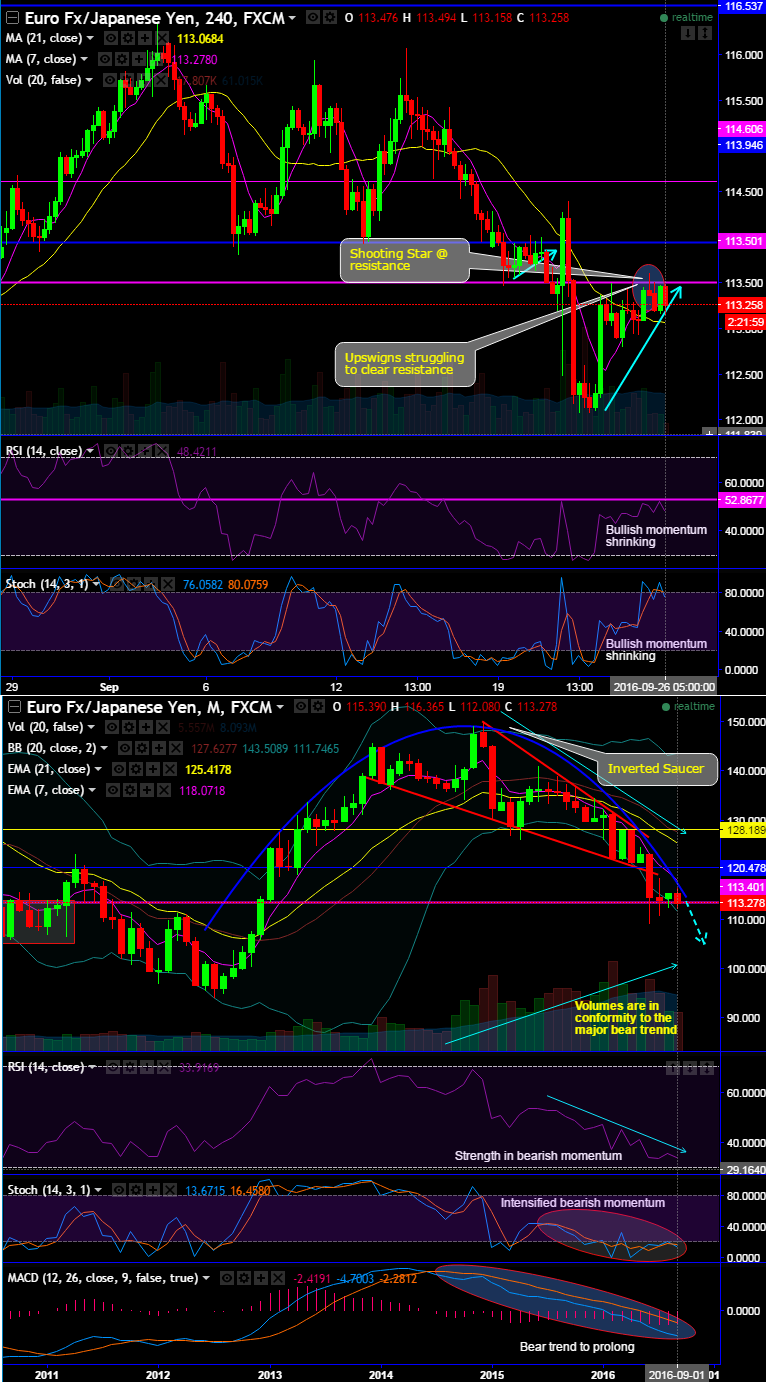

This pair is bearish bias for the day as the last week’s bull swings seem to have given up the last week’s momentum when the pair tested resistance at 113.501 levels, while the prices on monthly chart consistently rejected through inverse saucer to push further downside. Price behaviour has been hovering at this level from 3-4 sessions (see 4H chart).

Amid this tight range, a shooting star candle pattern is occurred at 113.376 levels to signify the weakness this pair.

On an intraday basis, the pair has broken the support at 113.193 levels.

The pair is still steaming up with heaps of other bearish indications by leading oscillator on both intraday and monthly charts.

Currently, on 4H plotting RSI (14) converging below near 46 levels and below 34 levels on monthly (while articulating).

While, %D crossover above overbought zones signals the buying momentum is shrunk, as a result bulls would be losing their buying interest despite rising prices.

Please be noted that the prices have been slipping through lower Bollinger band (on monthly plotting) where it has lost buying interest.

As stated earlier in our long-term trend analysis more downside targets are on the cards as the bears taking over the rallies to evidence every dips with ease and with huge volumes (see monthly charts for volumes conformity).

On monthly, MACD and moving averages are indicative to the bear trend to prolong.

The most probable scenario would be that it may retest recent lows of 110.824 levels.

Trade tips: As a result of above technical reasoning, on both speculative and hedging grounds, we recommend adding shorts in mid-month futures contracts for the 1st target of 112.917 which is next strong support and upon breach of this level once can also look forward the 2nd target at 113.131 by expiration but strict stop loss should be maintained at 113.629 levels.