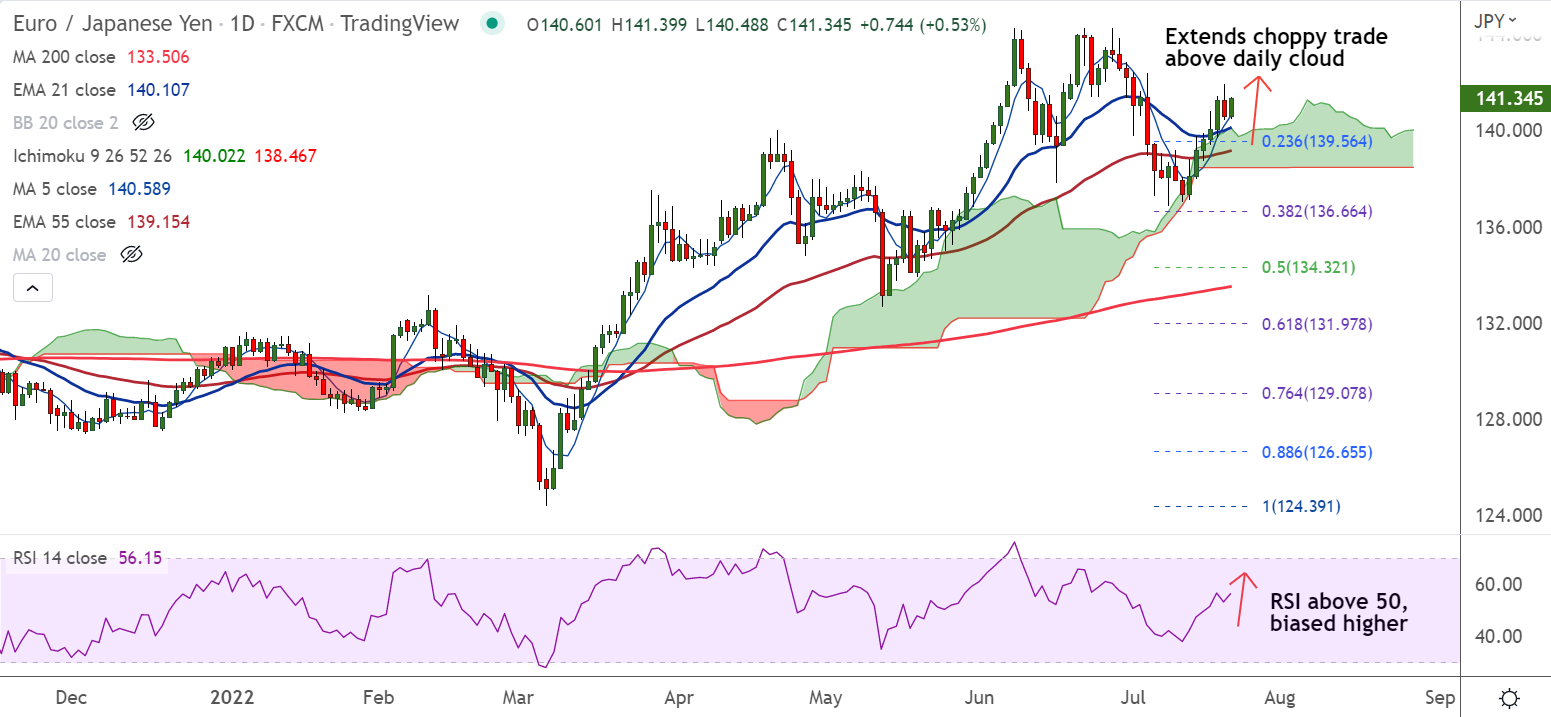

Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.56% higher on the day at 141.38 at around 06:10 GMT

Previous Week's High/ Low: 139.88/ 137.01

Previous Session's High/ Low: 141.93/ 140.42

Fundamental Overview:

Investors remain wary amid a looming interest rate hike in Europe and uncertainty over the westward supply of Russian gas.

The European Central Bank (ECB) meets later on Thursday to begin Europe's rate-hike cycle.

Hawkish expectations from the ECB appear to have underpinned the latest rebound in the single currency.

ECB is set for a 0.25% rate hike but widely discussed 50 bps move tease policy hawks.

Traders also await details of an ECB plan to steady bond spreads and to keep a lid on yields.

Market focus is on the resumption of gas flows along the biggest pipeline from Russia to Germany.

On the data front, Eurozone Consumer Confidence marked the record slump on Wednesday while flashing a -27.00 print for July.

Technical Analysis:

- GMMA indicator shows major and minor trend are bullish

- Momentum is bullish, Stochs and RSI are sharply higher

- Price action is above cloud and Chikou span is biased higher

- MACD confirms bullish crossover on signal line

Major Support and Resistance Levels:

Support - 140.32 (20-DMA), Resistance - 144.04 (Upper BB)

Summary: EUR/JPY trades with a bullish bias. Scope for further upside. Bullish invalidation only below daily cloud.