The Bank of Japan meets today and is scheduled to announce its monetary policy on Wednesday morning European time. We expect the BoJ to keep its policy unchanged and for Governor Haruhiko Kuroda to reiterate a relatively dovish stance, signalling that the BoJ intends to keep interest rates at current levels for a longer period of time. We expect the BoJ to keep its current policy intact until the end of 2019 at least.

Bearish EURJPY scenarios (see 127) if:

- The BoJ does not move even if core inflation rate rises more than expected.

- The Growth fails to rebound above 2%.

- EUR appreciation and/or sluggish core CPI delays ECB policy normalization

OTC outlook:

Most importantly, please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 127 levels so that OTM instruments would expire in-the-money.

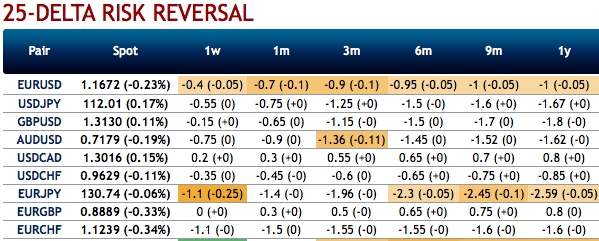

While negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating bearish risks in long run amid minor abrupt upswings in the short-term.

Technically, we already raised red flags about EURJPY bearish risks. For more readings, refer below weblinks:

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised various options strategies:

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -44 levels (which is bearish), while hourly JPY spot index was at -23 (mildly bearish) while articulating at (08:04 GMT). For more details on the index, please refer below weblink:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data