EUR/GBP was trading at 0.7850, slight weakness seen in the pair which has edged lower from session highs at 0.7871.

- Markets await UK employment and wage growth data due in the EU session which could impact BOE rate cut bets at Thursday's meet.

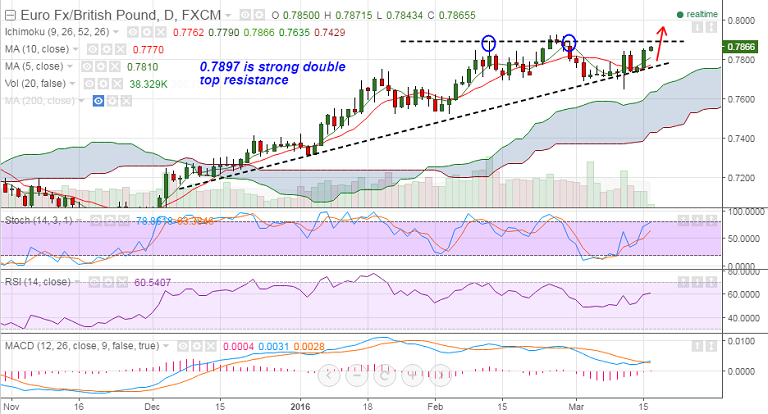

- Technicals for the pair are biased higher, price action is well above the cloud and momentum is positive.

- The pair finds strong resistance at 0.7897 (double top on Feb 11th and 29th), break above could see test of 0.7928.

- On the downside, supports are aligned at 0.7806 (5-DMA), then 0.7769 (10-DMA) and further below at 0.7735 (Mar 14th lows).