EURGBP’s 1-year forecast at 0.84 level reflects modest underperformance vs forwards. The near-term bearish stance remains the highest conviction part of the view.

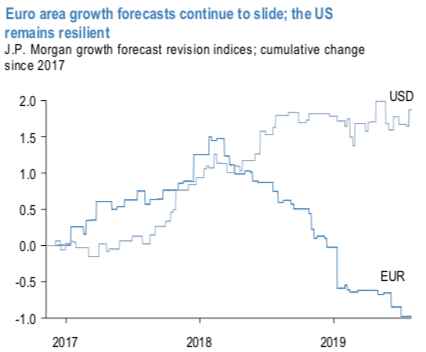

Despite the softer data, the easing regime-shift by the ECB is not yet fully reflected in positioning or valuations yet in our view. On positioning QE trades in either rates or FX do not yet show evidence of being crowded. Net investor positioning in FX is close to neutral even though it was 2-sigma short between Draghi’s pivotal Jackson Hole speech in 2014 and the actual onset of QE in January 2015 (refer 2nd chart). Similarly, net longs of either duration or peripheral spread are still below 1-sigma even though they increased to upwards of 2-sigma in 2015. Admittedly, the shorts in EUR FX may struggle to get back to 2015 levels.

On the flip side, a renewed focus on the UK’s political developments has caused GBP to extend its underperformance over the past month, making it among the worst-performing G10 currencies over this period. The trade-weighted index has weakened by another 3% over the past month, leaving it just 1% away from the post-Brexit and GFC lows. With this move, GBP is 20% cheaper than the 20-year average pre-Brexit (refer 1st chart). The Brexit discount ranges between 17% and 20% by our estimates — GBP REER is 20% cheaper than the pre-Brexit average and 17% cheap to its 20-year average.

The key driver of recent GBP weakness has been an increasingly hardliner stance by the new PM on Brexit negotiations as evident in ramping up of preparations for a possible “no-deal” outcome, Gove indicating that “no deal is now a very real prospect”, Boris Johnson’s office hinting that the next round of Brexit talks might not happen at all and apparent insensitivity of the government to recent GBP weakening.

The risks of a hard Brexit have not abated, and the macro picture continues to deteriorate. EURGBP projected at 0.935 across the forecast horizon (vs 0.90 year-end and 0.92 in 2Q’20 is also possible).

Contemplating all the above factors, EURGBP is expected to remain range-bound between 0.8250 key medium-term support and 0.9300 - 0.9415 areas with ECB policy not in play, focus once again turning to the Fed and other structural factors (valuations, external balances) which are EUR-supportive.

Hence, ahead of eurozone PMIs, on hedging puzzling swings in both short-term and long-term, we advocated initiating directional hedges that comprised of shorts in EURGBP futures contracts of September’19 delivery and simultaneously, the longs in futures of December’19 delivery for the major uptrend.

The exposures to directional factors are conditioned onto publicly available information to make them time-varying. The directional strategy is most likely to entail having the net long or short position in a market. It is betting upon the direction the overall market is going to move in. In this case, a trader who is going to take net long will likely benefit from a spike in the underlying spot FX in the long run. And net short will benefit from a short term potential decline. Courtesy: JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated