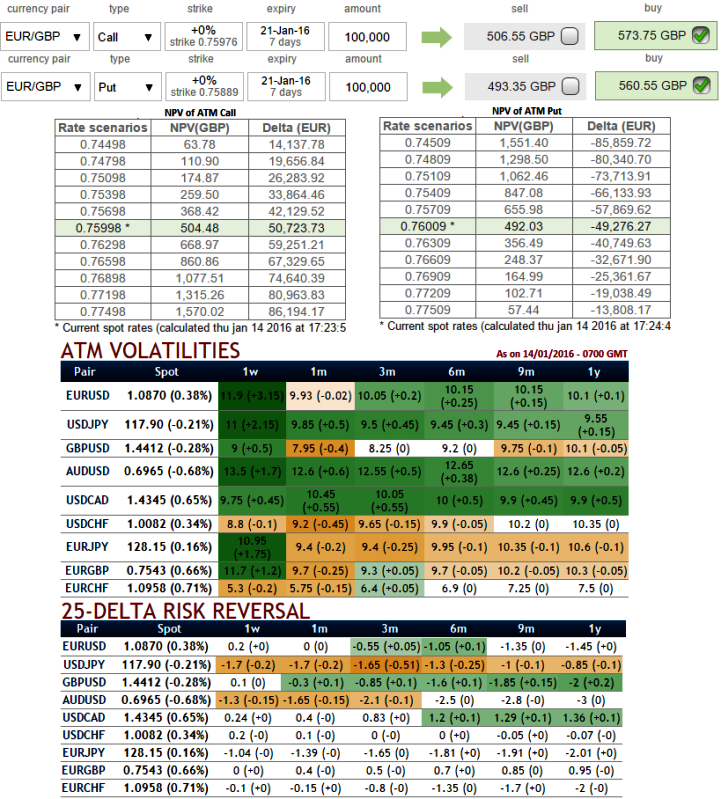

The implied volatility of ATM contracts for near month expiries of this the pair is at around 10%.

NPV of ATM call - 504.48 while Premiums trading 13.73% more than NPV at GBP 573.75 for lot size 100,000 units.

NPV of ATM put - 492.03 while Premiums trading 13.92% more than NPV at GBP 560.55 for lot size 100,000 units.

Delta risk reversals creeping up gradually with positive numbers signify hedging positions are well equipped for upside risks over the period of time. While current IVs of ATM contracts are at higher levels but likely to perceive hover around 10 in long run.

Hence, comparing this negligible difference in options premium with implied volatility and OTC market sentiments we think the hedging cost for upside risks would be economical as result of deploying ATM instruments.

Today's highlights of BoE's monetary policy:

Bank of England maintains key UK interest rate at 0.5%. This unchanged rate was no surprise to the forecasts.

BoE's QE in Jan total GBP stays flat at 375 bln GBP vs previous 375 bln GBP.

Now if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested calls have been overpriced then let's look at an example and a few specific scenarios with alternatives in order to get benefitted from upswings.

At this point of time, if you expect that EURGBP will spike up moderately over the next near future, which is currently at 0.7570 spot FX. You decide to initiate a bull put spread, buy next month +1% Out of the money -0.5 delta put option. Simultaneously, short 1W (-1%) in the money put with positive theta, So thereby our breakeven would be at 0.7568.

Notice in this instance that the put we bought is out of the money and the put we sold is in the money with an anticipation of EURGBP could rise or remain unchanged, and there onwards any abrupt fall would be taken care by longs in OTM put and your active longs in spot FX would be protected.

Maximum profit: The initial credit received for this trade, less commission costs.

The maximum risk is the difference between the two strike prices, minus the credit you received.

FxWirePro: EUR/GBP OTC market study signals us trend reversal - bull spreads back in action

Thursday, January 14, 2016 12:44 PM UTC

Editor's Picks

- Market Data

Most Popular