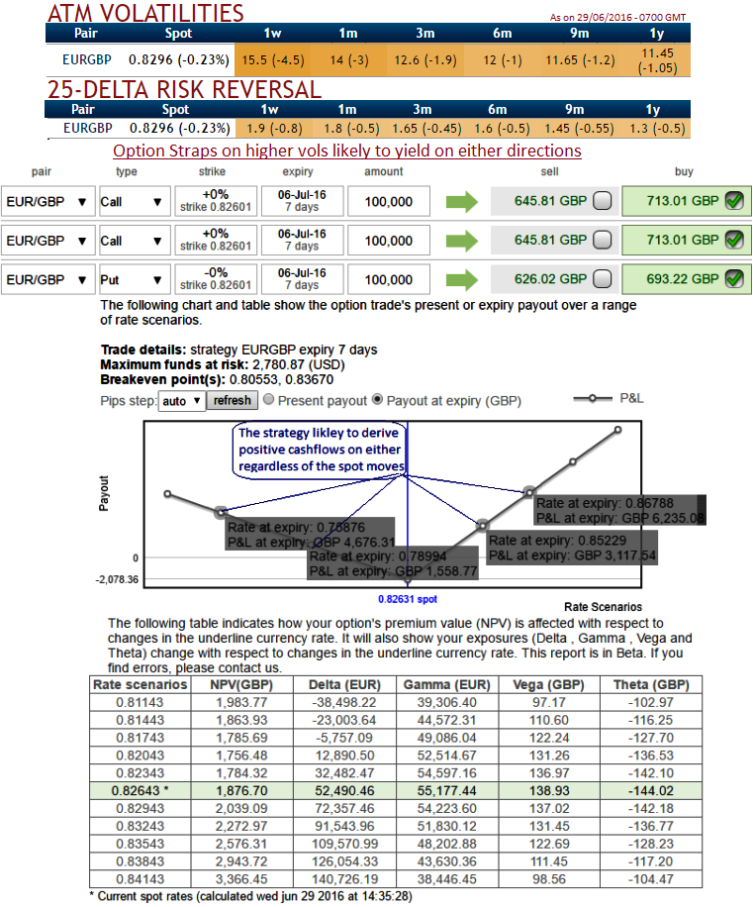

Please observe in the above nutshell showing IV shifts on a lower side but still above 15% that shows the intensity in hedging activities.

And the sensitivity tool evidences the efficiency of the options strategy as to how the vega has been responsive to the implied volatilities of EURGBP along with positive delta risk reversal numbers (even though positive tickers have been reduced.

But in a long run, hedging arrangements for upside risks are still visible (flashing at positive 1.8 for 1 month expiries to -1.3 for 1Y tenors).

1W at the money volatilities of 50% delta calls and puts are at trading around 15.25% which is reasonable as the vols currently are working in the interest of option holders as you can see IVs (still the 2nd highest among G7 currency space after GBPUSD) and corresponding movements in vega.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

Technically, , the pair has evidenced more than 61.8% Fibonacci retracements when bulls made the bottoms at 0.6975 levels and rejected exactly at 78.6% levels (see monthly charts).

Our bets for now, is to catch the decisive dips to build fresh longs as we could still foresee the momentum in the rallies.

Bulls hold stronger along with bullish momentum after jumping above DMAs and EMAs.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

Since we anticipate upswings in near term as per the signals generated by technicals as well as from risk reversals, this EURGBP option straps strategy should take care of both upswings and downswings, and yields handsome returns on the upside in the short term.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data