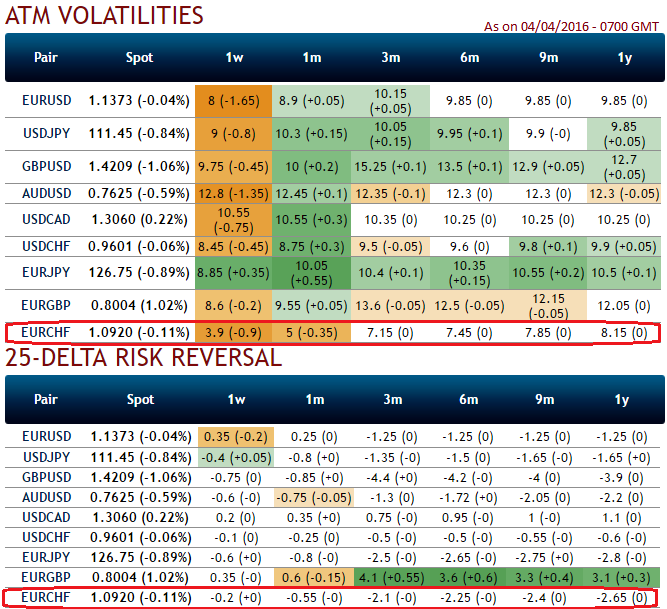

1W ATM IVs is at 3.9%, which is the least among G10 currency space.

25-risk reversals still indicates hedging activities for bearish risks.

Technically, the pair drifts in range between upper strikes at 1.0319 and lower strikes at 0.9850.

At current spot at 1.0923, it has been oscillating between this range. So, with range bounded trend and lower IVs keeping in consideration we would like to remain in safe zone by achieving certain returns through below option strategy.

Strategy: Long Put Butterfly Spread

Cash inflow would be certain as long as volatility is stagnant or even decreases.

Hence, the recommendation on buying (-1%) OTM -0.24 delta put while simultaneously shorting ATM put with similar expiries and buy (1%) ITM -0.84 delta put while simultaneously shorting another ATM put with similar expiries.

This strategy is structured for a larger probability of earning a smaller but certain profit as EURCHF is perceived to have a low volatility.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022