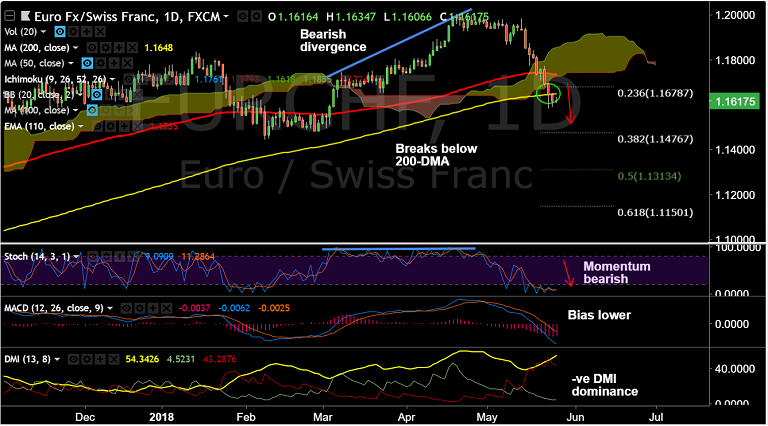

- EUR/CHF has shown a decisive break below 200-DMA, raising scope for further weakness.

- The pair is extending downward spiral from 1.20 handle hit in April month, on track for 4th straight week of losses.

- Upside in the pair was rejected at session highs at 1.1634 and 200-DMA at 1.1648 weighs on the upside.

- Price action has dipped below daily cloud and major exponential moving averages.

- Momentum studies are biased lower and bearish divergence keeps scope for further downside.

- Next major bear target lies at 1.1476 (38.2% Fib). Violation there could see further weakness.

- On the flipside, 200-DMA is immediate resistance. Retrace above could see test of 110-EMA at 1.1735.

Support levels - 1.1581 (May 23 low), 1.15, 1.1476 (38.2% Fib), 1.1446 (2018 low)

Resistance levels - 1.1648 (200-DMA), 1.1678 (23.6% Fib), 1.1735 (110-EMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-CHF-Trade-Idea-1321960) has hit all targets.

Recommendation: Book partial profits at lows, trail SL to 1.1680, hold for further weakness. Targets extended to 1.15/ 1.1475/ 1.1450

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.